Newsletter

Issue 33, April 2021 | www.scientificbeta.com

![]()

![]()

Bridging the Gap between Academia and Industry

Alignment or Greenwashing?

When one speaks of aligning an equity portfolio with the Paris Agreement or a Net-Zero trajectory, one makes the implicit assumption that reducing the overall carbon intensity or temperature of the portfolio will really contribute to the fight against climate change by having an impact on the greenhouse gas emissions of the issuers of the stocks included in the portfolio.

An initial and important dimension of this potential investor impact on real-economy emissions is that it is necessarily indirect and implemented through different transmission channels. Among these channels, we can clearly differentiate between engagement and capital allocation subjects.

Table 1: Three Channels for Investor Impact

Investor Impact Channel |

Objective and Functioning |

| Capital allocation | Quantitively altering activity through funding conditions (access to, and cost of, capital) or (directly or indirectly) influencing issuers to improve climate performance through signals |

| Engagement | Influencing issuers to improve climate performance through (direct/collective) dialogue and/or shareholder proposals and voting strategy |

| Engagement of other stakeholders (e.g., by public campaigning, policy advocacy, etc.) | Altering the market and regulatory environment to impact the supply/demand of/for products/services, funding conditions, authorised activities, and minimum performance standards in relation to climate performance |

Historically, the implementation of investors’ change agenda was done on the basis of a fairly limited view of the subjects of capital allocation and engagement. It essentially involved excluding companies with significant involvement in the supply chain, or even the consumption, of fossil fuels associated with unacceptable environmental consequences, such as coal or ‘dirty’ oil for example. Some of these exclusions followed, or were concurrent with, or at least consistent with, engagement of these same companies to reduce their involvement in controversial fuels, even though exclusion and engagement may have been performed by different investors. For investors favouring engagement, exclusion was often presented as a tool to be used when engagement is futile or after engagement has failed to produce the desired changes.

With the arrival of net-zero investment strategies, which promote alignment of all sectors and companies, it appeared that while it was consistent to extend engagement practices to all issuers, it seemed difficult of course to continue to think solely in terms of exclusions to implement capital allocation that was consistent with this objective of global alignment of the economy.

It is in this context that climate portfolio decisions could no longer correspond solely to very limited exclusions established on the basis of unacceptable activities or practices from a climate perspective but should also encompass very broad changes in portfolio allocations. These reallocations should favour climate leaders, whether involving extremely carbon efficient companies or companies that have committed to being so at a horizon and with a trajectory compatible with the climate alignment scenarios selected by the investor, or companies providing solutions to improve the carbon efficiency and alignment of other companies and economic agents. Conversely, climate laggards should be penalised by these same reallocations. Climate benchmarks, often marketed as alignment benchmarks and even officially labelled as such in the European Union, were promoted based on this idea of capital allocation compatible with the objectives of investor commitments to climate transition.

Unfortunately, one must acknowledge that while these benchmarks, or even active funds that refer to this net-zero objective, display fine weighted average carbon intensity metrics and fine commitments to respecting carbon intensity compressions over time, and in the same spirit, fine temperatures that relate carbon emissions targets to climate outcomes, these metrics refer to a global portfolio and not to stock-by-stock allocation decisions. Now, what is at stake with alignment is actually situated at the level of each company that is, or could be, a portfolio constituent, and not in a pure financial abstraction. The observation of the composition of so-called ‘aligned’ portfolios and benchmarks shows that there is no consistency between the metrics displayed at the portfolio level and the investment decisions at the stock level.

This inconsistency has an endemic explanation. The financial industry has always adopted di Lampedusa’s motto of changing everything so that everything can remain as it is. The latter has always resulted very tangibly in the setting of extremely narrow tracking error objectives, and climate strategies do not escape this rule.

Even though scientists are drawing attention to the need for a new industrial revolution to avert a climate catastrophe, which like previous industrial revolutions, would require considerable reallocation of capital, the financial industry is acting as if cap-weighted (CW) indices that reflect our current carbon-intensive economies remain the right reference for investment and minute deviations would be enough to solve the planet’s problems.

The vast majority of green portfolios are merely illusions of alignment strategies; naïve for some, cynical for others who see climate change as an opportunity for additional fees.

Indeed, there is nothing to guarantee that these fine portfolio metrics will result in investment decisions that are consistent at the stock level, and therefore incentivise the needed changes in the real economy. On the contrary, by favouring cap-weighted anchored tilting or optimisation approaches to control tracking error, most strategies or index providers which promote net-zero or alignment investing are incapable of guaranteeing any consistency between the climate performance of the stocks that make up the portfolio or the benchmark and the evolution of their weights. Where is the value in investors engaging issuers to improve their climate performance if at the same time these investors are going to favour climate deteriorators, i.e., companies whose climate performance deteriorates over time, through their portfolio decisions?

The basic psychology manuals show that if saying is not followed by doing, then the speaker cannot achieve any credibility or any truly positive reaction. At best, their speech will be an echo of a speech intended to satisfy them that will not be followed by any effects. That is the risk being run today by investors who merely engage issuers without drawing the conclusions in terms of portfolio decisions. In a context of that kind, the issuers will not hesitate to provide them with climate alignment answers that will not necessarily be followed by effects. Moreover, we often observe that many alignment plans proposed by corporates to respond to investor requests lack precision in terms of investment and real climate consequences of the choices of technology or production method and of the implementation of reporting on progress made. Ultimately, net-zero alignment is often evaluated in terms of discourse about change and formal governance rather than the capacity for real change. This approach organises ambitious objectives with deadlines that are beyond the anticipated term of the mandate of the directors of the companies engaged. It is best practice for the advocates of tracking error control to be satisfied with these medium or long-term climate promises without any real short-term consequences.

Today, apart from the pure climate benchmarks that we are offering with the Climate Impact Consistent Indices (CICI), we have not found a climate strategy that is not exposed to this obvious risk of greenwashing, in proportions that are often significant. The table below illustrates the problem in the case of a simple strategy tilting capitalisation weights by a score representative of carbon intensity, which is a fairly representative approach since many strategies using complex and costly climate alignment data often end up diluting or impairing climate signals emitted by companies by mixing these with stock market capitalisation data whose evolution, at least in the short term, has little to do with climate performance.

The results from Amenc et al. (2020) show that the score-weighted portfolio would increase the weight of more than 40% of deteriorators each year. The table below also shows that such an increase could happen even among the worst emitters. This clearly indicates that the firms that most need to be incentivised to go green would receive a "bad signal", since allocation, and hence demand, on their capital would increase. In contrast, CICI ensures that no climate deteriorator company sees its weight increase.

Score Weighted Low Carbon Portfolio (US Universe) |

Percentage of Deteriorators with Increasing Weight |

Percentage of the Worst Emitters (10%) with Increasing Weight |

2015 |

47.1% |

40.9% |

2016 |

41.2% |

60.5% |

2017 |

47.5% |

44.4% |

2018 |

40.0% |

39.6% |

2019 |

48.0% |

32.6% |

From Amenc et al. (2020) Table 6: Percentage of deteriorators and worst emitters receiving higher weights in score-weighted portfolio. The analysis is based on the Scientific Beta United States universe, from June 2014 to June 2019. Each June, we exclude coal stocks and classify the remaining stocks into deciles according to their carbon intensity over the previous year. Carbon intensity is the sum of scope 1 and scope 2 emissions divided by total revenue. Coal stocks are the ones that (1) belong to the coal industry or derive turnover of at least 30% from thermal coal mining, (2) belong to the utilities industry, which makes significant use of coal in its power generation fuel mix (30%), and (3) own coal reserves, except those in the iron and steel industry. The worst emitters are those classified within the highest decile, i.e., top 10% after exclusion of coal companies. The reported figures correspond to the weighted average carbon intensity (in tones/USDm), percentage of stocks among deteriorators that have higher weight in a score-weighted portfolio than in the previous year and the percentage of worst emitters that have higher weight in a score-weighted portfolio than in the previous year. The score-weighted portfolio weights securities based on their score times the market-capitalisation. Scores are transformed into cumulative distribution function of the normalised (truncated z-Score at 3 and -3) Carbon Intensity measures.

This greenwashing at stock level is even more pronounced when, in order to promote ambitious approaches, providers of climate solutions are prepared to use data that is attractive but ultimately turns out to lack robustness, to the detriment of metrics that are certainly more modest but have the merit of being verified or at least verifiable. This is particularly the case for Scope 3 emissions data, which represent emissions in the value chains of companies beyond their direct emissions and the indirect emissions linked to their purchases of electricity (Scope 1 and 2 emissions, respectively). The consideration of Scope 3 emissions is material as, on average, they represent more than three-quarters of company emissions. This importance, and the concern for improving footprint comparisons by recognising corporate differences in outsourcing or production method choices affecting the Scope 1 and 2 emissions, are arguments for the integration of Scope 3 emissions into the analysis. But this total emission data including Scope 3 still needs to be reliable. While the Scope 1 and 2 data is often subject to reporting obligations and are ultimately fairly convergent even when modelled by providers, this is not the case for Scope 3 data, where the correlation between the data produced by the providers does not exceed 30% on average. Indeed, this data is produced by estimation models that either lack transparency or use data in jurisdictions where reporting obligations are limited. Claiming that the Scope 1 and 2 data from their Asian sub-contractors is taken into consideration in the Scope 3 data of European or US companies is more a question of credulity than of measurement. Ultimately, to display fine portfolio-level Total Emissions metrics, index providers and asset managers will naturally be tempted to integrate unreliable Scope 3 emissions data into their asset selection and weighting processes that through their weight will override/dilute fairly reliable Scope 1 and 2 information. Here too, the old adage of garbage in/garbage out applies, and one might think that climate strategies are unfortunately consenting victims because the errors in determining the weights of the stocks relating to this data that is not particularly robust will often be magnified by optimisation processes.

It is this concern for the robustness of the weighting methodology that led Scientific Beta to be extremely careful on the use of Scope 3 data by limiting its use to minute inter-sector adjustments required for compliance with portfolio-level compression targets, but to keep only carbon intensities calculated on Scope 1 and 2 data for the individual weighting of stocks. Of course, the pressure on Scope 3 reporting is increasing and data providers are investing in its estimation, so it is not excluded that Scope 3 emissions could also be used to determine in-sector relative weights, but we prefer serious evaluations and robustness precautions to announcement effects.

While the subject of greenwashing is very present in portfolio decisions, it is also very present in the sector deviations observed in sector benchmarks. While there is extensive discussion on the usefulness of divesting from the fossil-fuel sector as of now, or on the contrary favouring its decarbonisation, in particular with the question of its participation in the energy revolution represented by the use of hydrogen, and while there is a consensus for calling the use of coal as a fossil energy into question, for all other sectors of the economy, the strong sector deviations observed in strategies that are termed ‘alignment’ demand attention. Even though the work on best practice in climate alignment recommends that intra-sector decarbonisation be favoured, and that the macro-consistency of the real economy represented by the weights of the sectors in CW benchmarks be preserved, we observe that the vast majority of climate strategies and benchmarks exhibit strong sector deviations by organising their decarbonisation through a reduction in the capital allocation to sectors with strong climate intensity. These under-representations can represent up to 50% in some sectors that are key not only for growth but also for energy transition, as is the case for the electricity sector. Even though considerable investment is necessary to ensure electrification of the economy and decarbonisation of electricity, its underfunding organised by climate-aligned benchmarks or strategies not only constitutes sector greenwashing but to our mind is a climate crime.

Here too, the CIC indices offered by Scientific Beta guarantee the investor that the sector deviations are limited and, as far as electricity is concerned, ensures that its funding is protected. At the level of each sector, the intra-sector alignment is guaranteed by funding of each company that takes account of their carbon intensity, their climate engagements, and their green revenues to allocate the capital. Ultimately, more than 80% of the strong level of decarbonisation of the CIC indices, whether EU PAB-compliant or not, is guaranteed by stock-level decisions. This ratio should be compared to that of many other strategies that guarantee the decarbonisation with sector effects of more than 50%. With the climate question, many investors want to give finance meaning again. It would be a real shame if this public interest requirement were spoiled by the inability to translate the desire for engagement shown by investors into benchmarks and portfolios.

Scientific Beta Climate Impact Consistent Indices

The Climate Impact Consistent indices (CIC) are part of the new pure climate indices launched by Scientific Beta. They are offered in two versions, one of which is compliant with the European Union Paris Aligned Benchmark (EU PAB) regulation. Their design is unique as it creates consistency between investors' engagement activities and investment decisions to maximise the potential for real-world impact.

It would be a dangerous self-delusion for investors to believe that simply holding a low carbon or even net-zero equity portfolio can effectively reduce emissions in the real-economy. The real impact of investment decisions from a climate alignment perspective comes from the consistency between these decisions and the climate performance of the companies that make up the portfolio. This is what is achieved by the CIC indices, which weight each stock according to their intra-sector climate performance and their alignment trajectory. As such, attractive climate metrics at the portfolio-level are neither achieved by divestment of sectors that are central to the transition nor by algorithms that condition climate action to financial characteristics.

As a representation of a pure climate investing strategy, CICI organises weighting decisions that directly affect companies' cost of capital and sends strong and consistent signals to the management of the companies on the relevance of improving climate practices. Thus, portfolio construction contributes to funding conditions and sends clear signals to the affected companies and other stakeholders. Since investors' main impact channels correspond to the financing and engagement of the companies themselves, the consistency between investors' climate engagement objectives and company-level investment decisions guarantees that the investment strategy maximises potential climate impact. Indeed, aligning the objectives of capital allocation with those of the engagement activity brings credibility to the latter by demonstrating the investor's commitment to climate-consistent investing and is in line with Net-Zero investment coalitions such as the Paris Aligned Investment Initiatives (PAII).

The CIC indices promote climate alignment of each sector of the economy since their weight is anchored to its broad cap-weighted weight.1 Hence, the financing of key sectors of the climate transition such as the electricity production sector, which requires extremely significant investment in the coming decades to achieve the 1.5C degree objective, is protected.

To achieve this alignment ambition, CIC indices were designed around five principle methodological objectives that address the main risks of greenwashing that are common in most alignment benchmarks:

- Ensuring that the decarbonisation at the global level is consistent right down to stock level and avoiding the global portfolio displaying greenwashing risk.

- Real sustainable growth ensuring real representation of all sectors in the economy and avoiding the risk of sector greenwashing.

- Ensuring that the climate performance and engagements are really taken into account in the evolution in issuers' weights.

- Appropriate use of data and metrics in portfolio construction to guarantee the climate robustness of the portfolio and avoid data greenwashing risks.

- Ensuring that the index has a very good level of investability, even though it is not anchored on cap weights.

These objectives result in an index construction process that is itself organised into five steps. Each step contributes to the overall index objective of enabling investors to send strong consistent signals to companies on their carbon activities while avoiding greenwashing risks which may arise when stock-level investment decisions result in poor or confused signalling to companies.

Figure 1: The CIC Indices' Construction Steps

Step |

CIC |

CIC EU PAB Compliant |

1 |

Exclusions |

|

Core ESG filter |

||

Non-reporting emissions (high emitting companies) |

||

PAB normative and activity exclusions

|

||

2 |

Intra-Sector Carbon Intensity Parity Weighting |

|

Weighting as per Scope 1+2 / revenues within carbon-oriented sectors |

||

Adjustments for disclosure, science-based targets and climate mitigation revenues |

||

3 |

Sector Neutrality Assurance |

|

Broad capitalisation-weighting anchoring (ex fossil fuel sector) |

||

4 |

Liquidity and Signal Consistency Constraints |

|

2-5-9 capping of CW-relative weights per regional liquidity (ATV) tercile |

||

Cap on issuers with deteriorating performance at previous rebalancing weights |

||

5 |

Conditional Mechanism (Sector-Weight Adjustment) |

|

7% carbon intensity annual self-reduction |

||

Carbon intensity lower than CW |

Carbon intensity 50% lower than CW

|

|

Minimum cumulative exposure to 'high climate impact' sectors |

||

We emphasise that the EU PAB-compliant version differs from the standard version through:

- A greater number of exclusions, leading notably to the elimination of nearly all stocks from the fossil fuel sector.

- The implementation of a carbon intensity reduction constraint that is more than 50% compared to the cap-weighted reference from the start of the index.

The two features may be seen as excessive for some investors, or indeed counterproductive for fossil fuel sector engagement. This is why Scientific Beta offers a standard version that allows investors to avoid having to conform with the European regulation in order to implement their alignment strategy.

The CIC Indices Reflect Pure Climate Objectives without Mixing Financial Considerations

Non-financial objectives such as the incorporation of a climate policy should not be mixed with financial objectives. Indeed, there is no academic consensus on a long-term reward associated with an ESG or low carbon factor. Mixing ESG and financial characteristics therefore makes no sense, and it is more appropriate to manage these two dimensions separately. The CIC indices therefore clearly prioritise climate change mitigation. This objective is achieved through the weighting of companies. The CIC indices' constituent weights are determined solely based on companies' carbon characteristics. Companies with a poor climate impact receive lower weights relative to their sector peers as defined by Scientific Beta's carbon-orientated sector classification. In contrast, alternative stock weighting methods may attempt to simultaneously consider financial characteristics and climate impacts. For example, cap-weight-tilted weighting or tracking-error-optimisation weighting methods are commonly adopted. Such weighting strategies may pose considerable greenwashing risks if a company's strong financial characteristics overshadow its poor climate record, leading to a higher weight and an inconsistent stock-level investment decision.

Table 1: Mixing Climate and Financial Strategies Sends Contradictory Signals

SciBeta US |

Percentage of Deteriorators with Increasing Weight |

Percentage of the Worst Emitters (10%) with Increasing Weight |

2015 |

47.1% |

40.9% |

2016 |

41.2% |

60.5% |

2017 |

47.5% |

44.4% |

2018 |

40.0% |

39.6% |

2019 |

48.0% |

32.6% |

Percentage of deteriorators and worst emitters receiving higher weights in score-weighted portfolio. The analysis is based on the Scientific Beta United States universe, from June 2014 to June 2019. Each June, we exclude coal stocks and classify the remaining stocks into deciles according to their carbon intensity over the previous year. Carbon intensity is the sum of scope 1 and scope 2 emissions divided by total revenue. Coal stocks are the ones that (1) belong to the coal industry or derive turnover of at least 30% from thermal coal mining, (2) belong to the utilities industry, which makes significant use of coal in its power generation fuel mix (30%), and (3) own coal reserves, except those in the iron and steel industry. The worst emitters are those classified within the highest decile, i.e., top 10% after exclusion of coal companies. The reported figures correspond to the weighted average carbon intensity (in tones/USDm), percentage of stocks among deteriorators that have higher weight in a score-weighted portfolio than in the previous year and the percentage of worst emitters that have higher weight in a score-weighted portfolio than in the previous year. The score-weighted portfolio weights securities based on their score times the market-capitalisation. Scores are transformed into cumulative distribution function of the normalised (truncated z-Score at 3 and -3) Carbon Intensity measures.

The CIC Indices are Truly Consistent as their Stock-Level Decisions do not Conflict with Portfolio Outcomes

Besides the CIC indices' pure climate stock-weighting, additional guarantees are in place in their design to ensure consistency between its stock-level decisions and portfolio outcomes. In particular, a signal consistency constraint is applied to stock weights to ensure that companies with increasing carbon intensity do not have increasing weights. As such, they explicitly avoid the greenwashing risk which arises when companies with deteriorating climate performance receive higher portfolio weights. This guarantee against climate deteriorators with increasing weights is a unique feature of Scientific Beta's CIC indices. Alternative climate investing indices which do not provide such a guarantee could result in the opposite signalling effect on companies regarding their climate impacts. The CIC indices' signal consistency constraint is applied together with a liquidity constraint to support their investability.

Table 2: The CIC Indices Avoid Greenwashing Risks

SciBeta Developed |

Percentage of Deteriorators with Increasing Weights at Index Level |

Worst 10% Emitters at Index Level that are Deteriorators with Increasing Weights |

||||

CW |

CIC |

CIC PAB |

CW |

CIC |

CIC PAB |

|

| 2014 | 46.4% |

0.00% |

0.00% |

14.60% |

0.00% |

0.00% |

| 2015 | 58.6% |

0.00% |

0.00% |

12.10% |

0.00% |

0.00% |

| 2016 | 54.8% |

0.00% |

0.00% |

7.50% |

0.00% |

0.00% |

| 2017 | 53.8% |

0.00% |

0.00% |

10.10% |

0.00% |

0.00% |

| 2018 | 50.6% |

0.00% |

0.00% |

15.10% |

0.00% |

0.00% |

| 2019 | 41.8% |

0.00% |

0.00% |

18.50% |

0.00% |

0.00% |

| 2020 | 31.9% |

0.00% |

0.00% |

6.10% |

0.00% |

0.00% |

The indices used are the Scientific Beta Developed Cap-Weighted index and the standard and EU PAB Compliant versions of the Scientific Beta Developed Climate Impact Consistent Index (CIC and CIC PAB). Results are computed on the SciBeta Developed universe (2013 - 2020) on June Review Dates. Deteriorators are defined as stocks included in the index with a higher carbon intensity decile compared to the previous year, where carbon intensity deciles are estimated on the global universe, using Scope 1+2 emissions normalised by revenues with adjustments for disclosure, science-based targets and climate mitigation revenues. A deteriorator with increasing weight is a stock classified as a deteriorator which also has a weight increase compared to its previous year weight. The table shows the number of deteriorators with increasing weights as a percentage of the number of deteriorators. Worst emitters at index level refer to stocks with the highest 10% Scope 1+2 carbon to revenues in the universe. A deteriorator with increasing weight is a stock classified as a deteriorator which also has a weight increase compared to its previous year's weight.

It is not just stock-level decisions that are consistent in the design of the CIC indices. Sector allocation also seeks to avoid greenwashing in the form of underweighting sectors with high carbon intensity. By anchoring sector weights to the broad cap-weighted benchmark, the CIC indices can reflect the real economy and ensure that each sector participates in the climate transition. This is aligned with the recommendations of the Net-Zero framework.

Table 3: The CIC Indices' Sector Allocation Reflects the Real Economy

SciBeta Developed 30-Jun-2013 to 31-Dec-2020 |

Absolute Weights |

Deviations |

|||

CW |

CIC |

CIC PAB |

CIC |

CIC PAB |

|

| BUILDING MATERIALS, BASIC METALS AND ALUMINIUM | 0.7% |

0.7% |

0.7% |

0.1% |

0.1% |

| OTHER MATERIALS | 4.7% |

5.0% |

5.6% |

0.2% |

0.9% |

| ELECTRICITY | 2.7% |

3.0% |

2.9% |

0.4% |

0.2% |

| FOSSIL FUELS | 6.8% |

6.3% |

0.0% |

-0.5% |

-6.8% |

| UTILITIES AND INFRASTRUCTURE | 3.1% |

2.9% |

3.2% |

-0.2% |

0.1% |

| AGRICULTURE, FOOD AND BEVERAGE | 4.3% |

4.4% |

5.0% |

0.1% |

0.6% |

| BUILDING | 3.6% |

4.0% |

4.4% |

0.4% |

0.8% |

| ELECTRONICS MANUFACTURING | 9.0% |

9.4% |

10.4% |

0.4% |

1.4% |

| OTHER MANUFACTURING | 21.5% |

22.1% |

24.3% |

0.6% |

2.8% |

| SALES | 7.0% |

7.6% |

8.5% |

0.6% |

1.5% |

| SERVICES | 18.0% |

17.2% |

17.3% |

-0.8% |

-0.7% |

| FINANCIAL AND INSURANCE ACTIVITIES | 18.7% |

17.6% |

17.7% |

-1.1% |

-1.0% |

The indices used are the Scientific Beta Developed Cap-Weighted index and the standard and EU PAB Compliant versions of the Scientific Beta Developed Climate Impact Consistent Index (CIC and CIC PAB). The analysis is based on yearly data. Sector data are averaged across all the years in the sample. Deviations are the sector weight of the CIC indices minus the sector weight of the Broad Cap-Weighted index.

Finally, the CIC indices' strong carbon metrics reduction can be clearly attributed to consistent stock-level investment decisions as demonstrated in Table 4 below, where we note that WACI reduction at portfolio-level can be attributed mainly to a stock effect rather than a sector effect. This highlights the consistency between stock-level and portfolio-level climate objectives.

Table 4: Excess Weighted Average Carbon Intensity (WACI) Decomposition

SciBeta Developed June 2020 |

CIC |

CIC EU PAB Compliant |

||||||

Excess |

Stock |

Sector |

Inter. |

Excess |

Stock |

Sector |

Inter. |

|

| BUILDING MATERIALS, BASIC METALS AND ALUMINIUM | -2.5 |

-2.7 |

0.2 |

-0.1 |

-3.2 |

-2.9 |

-0.5 |

0.2 |

| OTHER MATERIALS | -10.6 |

-11.1 |

1.0 |

-0.5 |

-10.7 |

-11.5 |

1.6 |

-0.8 |

| ELECTRICITY | -46.0 |

-48.1 |

6.2 |

-4.1 |

-51.3 |

-50.4 |

-2.9 |

2.0 |

| FOSSIL FUELS | -4.6 |

-4.8 |

0.3 |

-0.1 |

-18.0 |

0.0 |

-18.0 |

0.0 |

| UTILITIES AND INFRASTRUCTURE | -5.6 |

-5.4 |

-0.4 |

0.2 |

-6.6 |

-6.4 |

-0.5 |

0.3 |

| AGRICULTURE, FOOD AND BEVERAGE | 0.1 |

-0.2 |

0.3 |

0.0 |

0.6 |

0.1 |

0.4 |

0.0 |

| BUILDING | -2.4 |

-2.5 |

0.4 |

-0.3 |

-2.1 |

-2.4 |

0.7 |

-0.5 |

| ELECTRONICS MANUFACTURING | -0.9 |

-0.9 |

0.0 |

0.0 |

-0.7 |

-0.9 |

0.3 |

-0.1 |

| OTHER MANUFACTURING | -1.0 |

-1.4 |

0.4 |

-0.1 |

-0.8 |

-1.4 |

0.9 |

-0.2 |

| SALES | -1.4 |

-1.4 |

-0.2 |

0.1 |

-1.4 |

-1.4 |

0.0 |

0.0 |

| SERVICES | -1.4 |

-1.2 |

-0.2 |

0.1 |

-1.4 |

-1.2 |

-0.2 |

0.1 |

| FINANCIAL AND INSURANCE ACTIVITIES | -2.2 |

-2.2 |

-0.2 |

0.1 |

-2.2 |

-2.2 |

-0.1 |

0.1 |

| Total | -78.5 |

-81.7 |

7.9 |

-4.7 |

-97.8 |

-80.6 |

-18.3 |

1.1 |

The indices used are the Scientific Beta Developed Cap-Weighted index and the standard and EU PAB Compliant versions of the Scientific Beta Developed Climate Impact Consistent Index (CIC and CIC PAB). The table shows the sector WACI (Weighted Average Carbon Intensity) contribution for each Scientific Beta sector. The excess WACI is the difference in sector WACI contributions between the CIC and CW indices. The excess WACI is decomposed into stock, sector and interaction components. WACI is based on Scope 1, 2 emissions divided by revenue (t/USDm).

The CIC Indices Incorporate Forward-Looking Data and Adjustments to Reflect the Quality of Emissions Data

Throughout the CIC index construction process, careful checks and adjustments are performed so that forward-looking data on companies' climate impacts can be appropriately used while the scope and estimation of emissions data is properly addressed. In particular, the carbon intensity metric used for weighting stocks is Scope 1 and 2 emissions normalised by revenues. Scope 1 and 2 emissions are favoured for stock-weighting because they are reported by individual companies, and they provide a clear metric for engagement since they relate directly to companies' activities. Revenues are used to normalise emissions as they reflect companies' activity without financial market performance, unlike alternatives such as market capitalisation or Enterprise Value Including Cash.

The stocks' carbon intensities undergo adjustments to enhance their robustness and incorporate forward-looking data before they are used for weighting. Each stock is assigned the median carbon intensity of its sector's carbon intensity decile in the global universe to avoid over-reliance on individual company data. Thereafter, the carbon intensities are revised downwards as a reward for green revenues or pledges in the Science-Based Target (SBT) initiatives, and revised upwards as a penalty for not self-reporting emissions. A final shrinkage method is applied to the adjusted carbon intensities to recognise the improving data quality of self-reported emissions. Collectively, these adjustments capture forward-looking data on green-revenues and SBT pledges and result in a robust and meaningful carbon intensity metric for investors to engage companies on their environmental impact.

The CIC indices Maximise the Impact of Climate Investing in the Real Economy through Consistency

At a time when all investors are mobilising in the fight against climate change and when this mobilisation mostly involves strong engagement practices, CICI corresponds to a choice of benchmark that is consistent with this engagement. It avoids the inconsistency of the vast majority of optimised or CW-tilted climate benchmarks and means that investors, at the same time as they are engaging companies, whose climate practices and metrics need to be improved urgently, are not sending a contradictory signal to these same companies by increasing their investments in them even though they have not made an alignment commitment and their current carbon intensity is worsening. By allowing investors to put their money where their mouths are, CICI brings the strength of consistency to investors' climate commitments.

![]()

Climate Impact Consistent Indices, Scientific Beta white paper, February 2021

Visit the Scientific Beta Climate Impact Consistent Indices website

"Honey, I Shrunk the ESG Alpha"

Popular papers document positive alpha for equity strategies that favour ESG leaders1, and asset managers readily adopt the idea of a positive ESG alpha. For example, one asset manager "views ESG as a source of alpha that could lead to positive portfolio performance over time. […] . This premise rests on the thesis that value creation (or destruction) is influenced by more than financial capital alone, especially longer term."2

In recent research conducted by Scientific Beta3, we construct ESG strategies that have been shown to outperform in popular papers. We construct six different strategies in US equity markets and in developed markets outside the US. Each strategy goes long ESG leaders and short ESG laggards, using a different type of ESG score4. The scores we use are the aggregate ESG rating, each of the three component ratings, the rating trend, and finally, a combination of ESG rating level and trend.

Our main contribution is that we conduct a thorough risk adjustment when analysing the performance of these strategies. We assess performance benefits for investors when accounting for sector and factor exposures, downside risk, and attention shifts. These adjustments to performance are necessary to get a fair view of potential performance benefits to investors. The effect of these adjustments is clear-cut: They shrink the apparent alpha of ESG strategies to a level where none of the strategies delivers positive alpha.

Risk-Adjusting the Performance of ESG Strategies

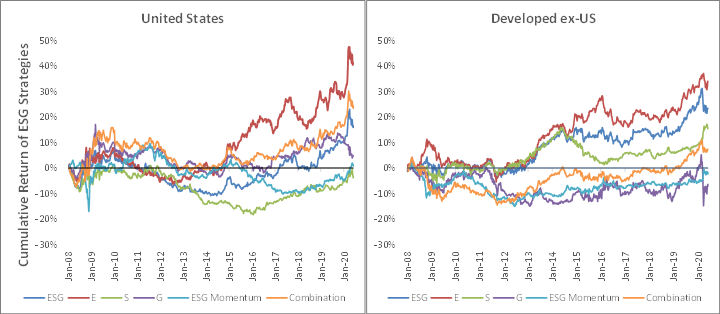

We first confirm that simple returns of ESG strategies may indeed look attractive, with annualised returns of up to almost 3% per year. The plot below shows cumulative returns of several strategies that go long in ESG leaders and short in laggards. The plot on the left-hand side shows US returns, and the plot on the right-hand side shows developed markets outside the US. Cumulative returns for the best performing strategies are substantial: above 30% in both universes.

Exhibit 1: Cumulative Returns of ESG Strategies

The plots show the time series of cumulative returns of the strategies, calculated at daily frequency. The sample period ranges from 1/01/2008 to 30/06/2020.

While such return plots are commonly shown in papers on ESG investing, they do not allow for sensible conclusions on the investment merits of a strategy. Even if ESG strategies have high returns, investors do not gain if these returns are due to sector biases or exposure to standard factors. The relevant question for investors is whether non-financial information in ESG scores offers additional performance benefits. Therefore, our analysis adjusts returns for sector biases and subtracts the effects that stem from exposure to standard equity style factors such as size, value, momentum, low risk, and quality (high profitability and low investment).

When accounting for sector biases and exposure to standard factors, none of the strategies we construct to tilt to ESG leaders adds significant outperformance, whether in the US or in developed markets outside the US. We show in the paper that 75% of outperformance of ESG strategies is due to quality factors that are mechanically constructed from balance sheet information. In addition, ESG strategies in the US equity market have a heavy tilt to the technology sector. After adjusting for such exposures, none of the strategies shows significant alpha. This finding implies that ESG ratings do not add value over information contained in sector classifications and factor attributes. Despite relying on analysis of non-financial information by hundreds of ESG analysts, ESG strategies perform like simple quality strategies constructed from accounting ratios.

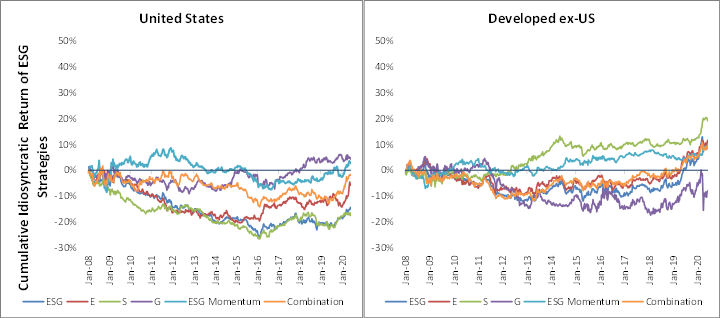

Exhibit 2 plots cumulative alphas after adjusting for sector biases and factor exposure. Cumulative alpha is the difference between the return of sector-neutral ESG strategies and the return component that is explained by their factor exposures.

Exhibit 2: Cumulative Returns Net of Sector and Factor Effects

The plots show the daily time series of cumulative 7-Factor alphas of the strategies (Sector Neutral Version). The cumulative alpha is computed as the difference between cumulative absolute returns of a strategy and the cumulative factor returns times the factor betas (estimated over the full sample). The sample period ranges from 1/01/2008 to 30/06/2020.

The graphs in Exhibit 2 show that ESG strategies consistently fail to deliver positive alpha when accounting for sector neutrality and exposure to standard factors. The flat lines in Exhibit 2 provide relevant information for investors on the performance benefits of ESG strategies because the results fully account for risks related to sector biases and factor exposures. In contrast, the upward-sloping lines in Exhibit 1 are not directly relevant because they ignore such risks.

Accounting for sector biases and factor exposures is crucial to conclude on value-added to investors. However, our simple multi-factor model with constant exposure parameters does not capture potential benefits of ESG strategies from reduced downside risk. Downside risk is reflected in asymmetric exposure. Investors are averse to losses that occur in bad times more than to losses that occur in good times. We extended the analysis in our paper to account for possible benefits in terms of downside risk reduction. The results reported in our paper show that ESG strategies do not offer significant downside risk protection5. Accounting for exposure of the strategies to a downside risk factor does not alter the conclusion that there is no value-added beyond implicit exposure to standard factors such as quality.

Rising Attention to ESG

Our analysis exploits a sample from January 2008 to June 2020. We have shown that, over this period, ESG strategies did not deliver value-added to investors in terms of financial performance. Even if ESG strategies do not provide outperformance over an extended period, they may outperform in the short term. In particular, if attention to ESG shifts upwards, ESG strategies have positive short-term performance. but their long-term expected returns decline (Pastor, Stambaugh, and Taylor 2020; Cornell 2020).

For investors, it is crucial to disentangle long-term returns from the effects of attention shifts. If upward attention shifts drive ESG returns over the recent period, investors need to conduct two adjustments to observed returns to form realistic expectations. First, returns of ESG strategies over periods with upward attention shifts are inflated. Increasing attention raises demand for a firm's shares, leading to higher prices. Investors need to deflate returns by subtracting the tailwind from rising attention. These deflated returns will of course look less attractive than the returns that were observed over the period. Second, following upward attention shifts, long-term expected returns will be even lower than they were before the attention shifts occurred. This is because increasing attention drives up prices and thus drives down expected returns. Investors thus need to adjust the deflated returns and subtract the drag imposed by rising valuations that occurred because of rising attention. In other words, not only will ESG strategy returns go back to their initial long-term average after a period of tailwind from upward attention shifts, but they will now deliver a lower long-term average return.

The following table illustrates this principle6:

Before Attention Shifts |

During Period when Attention Shifts Upward |

After Attention Shifts |

|

| Return of ESG Strategies (after removing random error) |

Initial Long-Term Average |

Initial Long-Term Average + Tailwind |

Initial Long-Term Average - Drag |

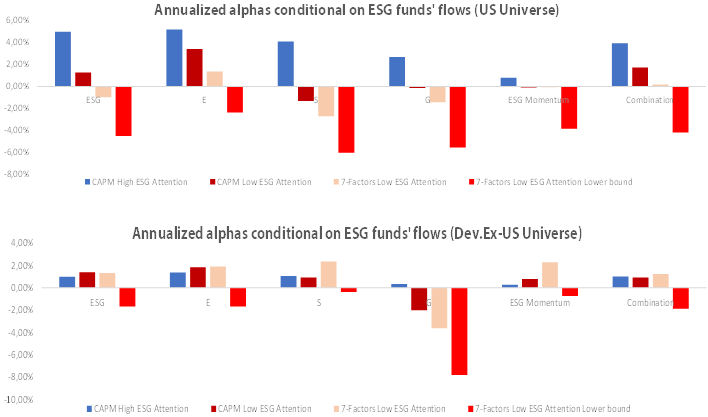

We assess the impact of attention shifts on ESG performance by distinguishing high and low attention states. We proxy for shifts of investor attention to ESG with flows into sustainable funds. We divide the sample into quarters with high and low attention, using the median value of fund flows into sustainable funds as the cut-off point to classify quarters.

We summarise our results on attention shifts in Exhibit 3. Outperformance during high attention periods, and when adjusting only for market exposure, is spectacular. The US strategies based on overall ESG ratings or on either of the three components all show substantial positive performance often exceeding 4% per year. However, outperformance shrinks and sometimes becomes negative when considering the low attention states. When adjusting for additional factors, outperformance shrinks further. Finally, accounting for parameter uncertainty does not lead to a single positive result for any of the strategies.

Exhibit 3: Shrinking ESG Alphas when Adjusting for Attention Shifts

The chart shows annualised alphas conditional on realisations of the ESG attention shift proxy for six ESG strategies constructed using the Scientific Beta US universe (top chart) and the Developed Ex-US universe (bottom chart). The attention shift proxy used is net flows in US ESG funds (ESG_FF),. For each strategy we report the average CAPM alpha conditional on ESG_FF being above the median, the average CAPM alpha conditional on ESG_FF being below the median, the average 7 Factors alpha conditional on ESG_FF being below the median, and the 95% lower bound of the 7 Factors alpha conditional on ESG_FF being below the median. The time sample is from January 2008 to June 2020.

These results show that alpha estimated during low attention periods is up to four times lower than alpha during high attention periods. Further analysis reveals that the attention shifts occurred over the later part of the sample period with a strong rise in attention since 2013 onwards. For this reason, studies that focus on the recent period tend to overestimate ESG returns. Investors need to be wary of analysis of ESG alpha that is limited to short periods which coincide with rising attention to ESG7.

Conclusion

Our study delivers important insights for investors. As a general matter, our analysis provides an example of how one can document outperformance where there is none: it suffices to omit necessary risk adjustments. Concerning ESG strategies, our findings question a widespread practice of using ESG as an alpha signal. They do not question the value-added of such strategies on other dimensions. Investors should ask how ESG strategies can help them to achieve objectives other than alpha, such as aligning investments with their values and norms, making a positive social impact, and reducing climate or litigation risk. Investors would benefit from further research on these important questions.

![]()

“Honey, I Shrunk the ESG Alpha”: Risk-Adjusting ESG Portfolio Returns, Scientific Beta white paper, April 2021

Interview with Simon Karaban, Senior Vice President of SGX Index Services at Singapore Exchange (SGX)

In this interview, Simon Karaban, Senior Vice President of SGX Index Services at Singapore Exchange (SGX), discusses future opportunities in the Asian market and the benefits of Scientific Beta's dynamic defensive, pure climate and inflation-protection offerings specifically for investors in this region and globally.

Simon Karaban,

Senior Vice President, SGX Index Services,

Singapore Exchange (SGX)

You are the head of SGX’s index business (iEdge) and are also the global head of the asset management, investment bank and wealth management customer channels for Scientific Beta. How do these separate responsibilities combine for the Asian market and what is your vision for the Asian market going forward?

The iEdge business is focused on delivering bespoke indexing solutions first and foremost in Asia and then subsequently to our clients in Europe. The very nature of such engagements sees the iEdge business working rather closely with Investment Banks and Asset Management clients, who will tend to possess an in-house view and then work collaboratively with iEdge to transform that view into an index format. Given our background in working very closely with these customer channels it was only natural for me to then assume responsibility for promoting Scientific Beta's offerings to both banking and asset management prospects. This natural synergy represents an exciting new chapter for the broader SGX index business where we can complement a flexible custom solution with a top-down research-driven offering by Scientific Beta in the areas of Smart Beta, ESG, Climate and Thematic indexing.

The Asian market is certainly increasing its adoption of index-based investments in the form of either ETF's issued by asset managers across the region or Structured Products offered by investments banks. While lagging the USA and Europe in this regard, we see a significant growth trajectory for index investing that will be complemented with a greater level of sophistication across the region that will necessitate a sophisticated offering that Scientific Beta can offer. We feel the region is underserved by some of the more established providers and we are very excited by the prospect of introducing true innovation into Asia through a robust and reputable research process anchored in academia.

You hosted a webinar on April 8 on defensive equity solutions to improve the performance of multi-asset portfolios. Could you tell us briefly about this dynamic defensive offering and its benefits for Asian investors?

Yes, we were very excited about introducing the Scientific Beta Dynamic Defensive Strategy to the wealth management audience in Asia in particular. The dynamic defensive offering by Scientific Beta offers protection during periods of heightened volatility and market drawdown while offering better risk-adjusted returns over the long-term relative to traditional cap-weight market benchmarks. This is achieved through robust and diversified exposure to Low Volatility with a risk control overlay that is underpinned by innovations in volatility forecasting. During our webinar we were effectively able to demonstrate the benefits of our dynamic defensive solution relative to some of the traditional offerings in the market which tend to fail in their attempt to mitigate tail risk.

The exciting thing about this defensive solution is when it is considered within the context of a broader multi-asset portfolio. In speaking with Private Banks in Asia they face some major challenges with their clients because the fixed income component of the portfolio is offering very low returns in an ultra-low rate environment, while an allocation to higher yield and longer duration investments is very risky in the context of increasing inflation and a rising rate environment. This problem can be addressed by shifting part of an investor's fixed income allocation to our dynamic defensive solution which significantly improves the risk-adjusted returns for multi-asset portfolios. Investors in Asia can therefore increase their exposure and participation in equity markets without taking on more risk.

Scientific Beta recently launched a unique pure climate index offering. How do you see investors in Asia evolving in the area of climate investing?

This new pure climate offering really does speak to Scientific Beta's broader expertise and experience in validating data and their superiority in quantitative portfolio construction. The new Climate Impact Consistent (CIC) Index offering is the first of its kind globally where the selection and weighting of stocks is directly related to the climate performance of the underlying companies. Our competitor offerings tend to tilt stocks by combining carbon performance with market-cap and even suppress sectors through optimisation-based approaches that may reduce overall portfolio carbon intensity, however it can result in a stock's weight increasing while its carbon performance is deteriorating – this is greenwashing in portfolio format. Scientific Beta's approach ensures consistency at both the portfolio and stock level while achieving significant decarbonisation targets.

Institutional investors across Asia see climate change as an existential threat and are increasingly considering both climate impact and climate transition risks within the context of their existing investments. Increasingly, we also evidence a more concerted effort by large pension funds in the region to consider overall portfolio decarbonisation and company engagement to be able to facilitate change. As they consider this and support net-neutral objectives, however, asset owners in Asia may not be in full agreement with the implementation of EU taxonomy and Paris Alignment since it is not congruous with the real-economy for Asia. Scientific Beta therefore offers a version of CIC that is not EU Paris Aligned, however nonetheless constructed in such a way to encourage meaningful decarbonisation of the real economy.

In April, Scientific Beta is launching a unique index offering that protects equity portfolios against counter-performance relating to inflation surprises. Do you think that private and institutional investors in Asia will be interested in this type of strategy?

Yes, this is an exciting launch which can appeal to multiple customer channels in my opinion. Back in September 2019, Scientific Beta published very thought-provoking research in the Journal of Portfolio Management on the topic of macroeconomic risks in the context of equity investing and the upcoming launch in April builds on the depth of research and expertise on this topic. Inflation is a very real threat for both institutional and retail investors, particularly as it relates to longer duration liabilities that are particularly sensitive to the threat of inflation. Today, we see an unprecedented level of accommodative monetary easing that is coupled with record fiscal stimulus, which is simultaneously being met with supply-side challenges and cost-push inflation. There is indeed a growing chorus of investors who are seeking inflation-protection as a result, however it seems they are looking for it in the wrong places with cyclical commodities exposure which is not ideal given the boom-bust nature of commodities cycles. Investors would be much better off with a solution that offers inflation protection, while also providing continued exposure to longer term equity risk premia. Investors within the region here in Asia would indeed benefit by substituting part of their core exposure to an inflation-protected equity portfolio that would better allow them to preserve their wealth over the long term.

Simon Karaban is Senior Vice President of SGX Index Services at Singapore Exchange (SGX). He joined SGX in March 2013 and has led the development and build of the index business for SGX, known as SGX iEdge. More recently he has assumed the responsibility for leading the Scientific Beta business development responsibilities across the global asset management, investment bank and wealth management customer channels. Prior to SGX, he was the Director of Research and Design for S&P Dow Jones Indices based in Hong Kong, where he led the R&D initiatives for indices across asset classes for the Asia Pacific region. He graduated from the University of Sydney with a Bachelor of Economics. He also holds a Masters in Finance from the University of Technology, Sydney.

Scientific Beta has forged partnerships with asset managers who not only replicate its indices but also propose open funds enabling investors to readily invest in the strategies proposed by Scientific Beta that they have selected. In this issue, we focus on Desjardins Global Asset Management.

Desjardins Launches an RI Emerging Markets Exchange Traded Fund Based on a Scientific Beta Index

On March 12, 2021, Desjardins Global Asset Management Inc. (DGAM) announced the launch of a new exchange traded fund listed on the Toronto Stock Exchange adhering to a responsible investment policy – the Desjardins RI Emerging Markets - Low CO2 Index ETF (DRME).

The fund offers broad exposure to emerging markets equity, integrates environmental, social and governance (ESG) considerations and proposes a significant reduction in the carbon intensity of the portfolio. It seeks to replicate the performance of the Scientific Beta Desjardins Emerging Markets RI Low Carbon Index, net of fees and expenses. Under normal market conditions, the fund will primarily invest in large and mid-cap companies from the Scientific Beta Emerging Markets universe while seeking to deliver a significant reduction in the weighted average carbon intensity of the fund's portfolio and ensuring that all constituent issuers meet pre-determined ESG standards.

"We are pleased to offer our investors attractive growth potential while supporting the transition to a greener economy through the largest range of responsible investment products in Canada", explained Nicolas Richard, Chief Executive Officer of DGAM.

The Desjardins RI Emerging Markets - Low CO2 Index ETF complements the range of ETFs designed to significantly reduce carbon intensity relative to traditional equity indices. Since 2017, Desjardins Global Asset Management has managed a range of ETFs listed on the Toronto Stock Exchange, based on Scientific Beta solutions. This comprehensive range includes ETFs tracking multi-factor low carbon and controlled volatility indices, and additional ETFs whose primary objective is to contribute to the fight against climate change by divesting from the most carbon intensive companies, while respecting norms-based Responsible Investment (RI) constraints.

White Papers

In a concern for transparency, and as part of its aim to help investors to understand and to invest in smart beta equity strategies, Scientific Beta has published a large number of white papers that are available on the Scientific Beta platform.

Featured White Papers

Climate Impact Consistent Indices

February 2021

The Climate Impact Consistent (CIC) Indices have been designed as a tool for Net-Zero-committed investors seeking to play their part in the fight against climate change. The bottom-up index construction methodology aims to allocate capital to each company in proportion to its Net-Zero alignment, as measured through its carbon emissions intensity, its emissions disclosure/quality, its forward-looking emissions targets and their credibility, and its revenues from climate solutions. This ensures consistency between bottom-up stock-level investment decisions and the overall climate impact goals of the investor and thereby avoids the greenwashing risks of strategies that focus on the headline decarbonisation figures while sending inconsistent investment signals at stock level. Scientific Beta offers two versions of the CIC Indices, one of which complies with the regulation defining the minimum requirements of EU Paris-aligned Benchmarks (EU PAB) but avoids the pitfalls of this regulation.

The Climate Impact Consistent (CIC) Indices have been designed as a tool for Net-Zero-committed investors seeking to play their part in the fight against climate change. The bottom-up index construction methodology aims to allocate capital to each company in proportion to its Net-Zero alignment, as measured through its carbon emissions intensity, its emissions disclosure/quality, its forward-looking emissions targets and their credibility, and its revenues from climate solutions. This ensures consistency between bottom-up stock-level investment decisions and the overall climate impact goals of the investor and thereby avoids the greenwashing risks of strategies that focus on the headline decarbonisation figures while sending inconsistent investment signals at stock level. Scientific Beta offers two versions of the CIC Indices, one of which complies with the regulation defining the minimum requirements of EU Paris-aligned Benchmarks (EU PAB) but avoids the pitfalls of this regulation.

"Honey, I Shrunk the ESG Alpha": Risk-Adjusting ESG Portfolio Returns

April 2021

In this paper, we show that there is no solid evidence supporting recent claims that ESG strategies generate outperformance. We construct ESG strategies that have been shown to outperform in popular papers. We assess performance benefits to investors when accounting for sector and factor exposures, downside risk, and attention shifts. Simple returns of ESG strategies look attractive, with annualised returns of up to almost 3% per year. But when accounting for exposure to standard factors, none of the twelve different strategies we construct to tilt to ESG leaders adds significant outperformance, whether in the US or in developed markets outside the US. 75% of outperformance is due to quality factors that are mechanically constructed from balance sheet information. ESG strategies do not offer significant downside risk protection either. Accounting for exposure of the strategies to a downside risk factor does not alter the conclusion that there is no value-added beyond implicit exposure to standard factors such as quality.

In this paper, we show that there is no solid evidence supporting recent claims that ESG strategies generate outperformance. We construct ESG strategies that have been shown to outperform in popular papers. We assess performance benefits to investors when accounting for sector and factor exposures, downside risk, and attention shifts. Simple returns of ESG strategies look attractive, with annualised returns of up to almost 3% per year. But when accounting for exposure to standard factors, none of the twelve different strategies we construct to tilt to ESG leaders adds significant outperformance, whether in the US or in developed markets outside the US. 75% of outperformance is due to quality factors that are mechanically constructed from balance sheet information. ESG strategies do not offer significant downside risk protection either. Accounting for exposure of the strategies to a downside risk factor does not alter the conclusion that there is no value-added beyond implicit exposure to standard factors such as quality.

Practitioner Publications

Selected reference papers that have been published recently by Scientific Beta in academic journals.

Carbon Intensity Bumps on the Way to Net Zero

Journal of Impact & ESG Investing, Spring 2021

The recent update of the EU Benchmark Regulation mandates the use of enterprise value rather than revenues as the denominator for the computation of carbon intensity. The regulator’s advisers justified the substitution by its detrimental impact on the coal industry and affirmed that enterprise value—like revenues—would be applicable to both equity and fixed-income indices. However, all companies with low enterprise value to sales have suffered from the change, and enterprise value cannot be computed in the absence of equity market capitalisation. Furthermore, enterprise value inherits equity market volatility, which weakens the link between changes in measured carbon intensity and underlying emissions and produces metric volatility that rewards an issuer’s market performance over its decarbonisation performance. Impact-concerned investors that wish to guide portfolio decarbonisation by carbon intensity should favor the use of revenues as denominator over that of enterprise value so as to encourage reductions in emissions and gains in process efficiency in the real economy.

The recent update of the EU Benchmark Regulation mandates the use of enterprise value rather than revenues as the denominator for the computation of carbon intensity. The regulator’s advisers justified the substitution by its detrimental impact on the coal industry and affirmed that enterprise value—like revenues—would be applicable to both equity and fixed-income indices. However, all companies with low enterprise value to sales have suffered from the change, and enterprise value cannot be computed in the absence of equity market capitalisation. Furthermore, enterprise value inherits equity market volatility, which weakens the link between changes in measured carbon intensity and underlying emissions and produces metric volatility that rewards an issuer’s market performance over its decarbonisation performance. Impact-concerned investors that wish to guide portfolio decarbonisation by carbon intensity should favor the use of revenues as denominator over that of enterprise value so as to encourage reductions in emissions and gains in process efficiency in the real economy.

Supplements in Partnership with Industry Publications

EDHEC has established partnerships with a number of industry publications to produce special editorial supplements providing industry-relevant research of the highest academic standards.

P&I Research for Institutional Money Management

December 2020

The latest Scientific Beta special issue of the Research for Institutional Money Management supplement to Pensions & Investments discusses a number of themes such as the importance of sticking with factor strategies through periods of crisis, the risk of crowding, the robustness of smart beta strategies, the place for an intangible-adjusted value factor, the compatability of ESG engagement and divestment, Scientific Beta's new dynamic defensive solution that is really low volatility, and its historical volatility adjustment risk control option for investors who want their factor strategy to remain defensive during episodes of severe market stress.

The latest Scientific Beta special issue of the Research for Institutional Money Management supplement to Pensions & Investments discusses a number of themes such as the importance of sticking with factor strategies through periods of crisis, the risk of crowding, the robustness of smart beta strategies, the place for an intangible-adjusted value factor, the compatability of ESG engagement and divestment, Scientific Beta's new dynamic defensive solution that is really low volatility, and its historical volatility adjustment risk control option for investors who want their factor strategy to remain defensive during episodes of severe market stress.

Why Investors Should Keep Faith with their Factor Strategies

We first discuss the question of why investors should stick with their factor strategies through periods of crisis. The main conclusion is that the importance of diversification across the six consensus risk factors remains intact.

Smart Beta Strategies and the Crowding Effect

We discuss crowding risk in smart beta strategies and find that assertions that the popularity of smart beta strategies will ultimately cancel their benefits are not based on solid evidence.

Examining the Robustness of Various Smart Beta Strategies

We assess the robustness of a set of competitor and Scientific Beta indices both from an index design point of view and through the lens of our robustness measurement protocol.

Should Intangible Assets be Included in the Definition of Value?

Since the value factor proxy does not aim to capture the true value of a stock, including omitted intangible assets in the accounting book value is in line with the risk-based explanation for the value factor.

ESG Engagement and Divestment

It is often argued that an investor who is dissatisfied with a company’s ESG behaviour should stay on as a shareholder and engage with it. We show that far from being incompatible with ESG engagement, ESG filtering sends a clear and consistent divestment message that allows an effective engagement policy to be implemented.

Limitations of Traditional Defensive Strategies

Traditional defensive solutions suffer from negative exposures to reward factors other than the low volatility risk factor, as well as concentration and strong exposures to fixed-income risks. More importantly, they can suffer from huge peaks of volatility during market crises. Scientific Beta offers a new dynamic defensive solution that is really low volatility by combining a robust low volatility index and a maximum volatility protection risk-control option.

Benefits of a Historical Volatility Adjustment Risk Control Option

Investors who want their factor strategy to remain defensive during episodes of severe market stress would benefit from the application of a volatility-control option. We present the historical volatility adjustment (HVA) risk-control option.

Pensions & Investments Research for Institutional Money Management Supplement December 2020 – Meet the Authors Webinar Recording

On 15 December, 2020, several of the authors who participated in the December 2020 issue of the Pensions & Investments Research for Institutional Money Management supplement, presented the selection of articles below on the occasion of a special webinar.

- Examining the Robustness of Various Smart Beta Strategies

- Should Intangible Assets Be Included in the Definition of Value?

- ESG Engagement and Divestment

- Benefits of a Historical Volatility Adjustment Risk-Control Option

Recording of the Webinar Presenting the "Sustainable Investing with ESG Rating Uncertainty" Paper Now Available for Viewing

At a special webinar held on 4 March, 2021, the authors of a recent publication from the EDHEC-Scientific Beta "Advanced Factor & ESG Investing" research chair entitled "Sustainable Investing with ESG Rating Uncertainty", presented their research which analyses the equilibrium implications of ESG rating disagreement for portfolio decisions and asset pricing.

Joined by Felix Goltz, Research Director at Scientific Beta and Member of the EDHEC Scientific Beta "Advanced Factor & ESG Investing" research chair, the authors of the paper – Doron Avramov, Professor of Finance, IDC Herzliya; Si Cheng, Assistant Professor of Finance, Chinese University of Hong Kong (CUHK) Business School; Abraham Lioui, Professor of Finance, EDHEC Business School and member of the EDHEC Scientific Beta "Advanced Factor & ESG Investing" research chair; and Andrea Tarelli, Assistant Professor, Catholic University of Milan – presented their study, whose findings help reconcile the mixed evidence on the cross-sectional return predictability of ESG ratings and suggest that the lack of consistency in ESG ratings could distort the risk-return trade-off.

![]()

Sustainable Investing with ESG Rating Uncertainty, EDHEC-Scientific Beta "Advanced Factor & ESG Investing" research chair publication, December 2020

More About the EDHEC Scientific Beta Advanced Factor & ESG Investing Research Chair

Scientific Beta Launches Unique Series of Pure Climate Indices that Translates Companies' Climate Performance and Alignment Engagement into Portfolio Decisions

The Climate Impact Consistent Indices (CICI) allow investors to promote real-world emissions reductions.

Scientific Beta has announced the launch of a unique series of Climate Impact Consistent Indices (CICI) that make investment decisions and engagement practices consistent in order to maximise their impact.

The CICI offering is the only pure climate index offering on the market. Unlike traditional climate indices and benchmarks, which combine financial and climate criteria, either in the form of tilts applied to reference cap weights, or of carbon intensity score optimisation under tracking error constraints, the CIC indices make the weights of stocks depend solely on their climate performance. This strong methodological choice provides the CIC index with all of its consistency by avoiding financial considerations contradicting climate considerations.

CICI is positioned for implementing the recommendations of the Net-Zero investment coalitions at the portfolio-construction level. In particular, the Paris Aligned Investment Initiative (PAII) Framework states that one of the key elements of a "Paris aligned stewardship approach" is to develop an engagement strategy with a feedback loop to portfolio construction. CICI allows for the practical implementation of this approach where engagement and portfolio construction are neither mutually exclusive nor independent and instead can and should be mutually reinforcing. The CICI portfolio construction methodology thus greatly bolsters the power of an investor's engagement strategy by establishing its credibility thanks to the consistency between the actions that it undertakes to engage companies on better climate alignment, and the investment decisions with respect to the same companies.

Commenting on the launch of the CICI offering, Dr Noël Amenc, CEO of Scientific Beta, said, "The weighting approach at the heart of CICI maximises the possible synergies between portfolio construction and engagement. By putting their money where their mouths are, investors bolster the potential for successful engagement. In this respect, Scientific Beta's Climate Impact Consistent Indices not only align with ESG impact considerations but also promote real-world impact through a unique approach to portfolio construction."

![]()

Visit the Scientific Beta Climate Impact Consistent Indices website

Scientific Beta Joins the Institutional Investors Group on Climate Change (IIGCC)

Scientific Beta is pleased to announce that it has become an associate member of the Institutional Investors Group on Climate Change (IIGCC), the European membership body for investor collaboration on climate change and the voice of investors taking action for a prosperous, low carbon future. The mission of the IIGCC is to support and enable the investment community in driving significant and real progress by 2030 towards a net zero and resilient future through capital allocation decisions, stewardship and successful engagement with companies, policy makers and fellow investors.

The IIGCC works with business, policy makers and fellow investors to help define the investment practices, policies and corporate behaviours required to address the long-term risks and opportunities associated with climate change. Addressing key issues through a number of programme areas, it also works closely with other investor groups and plays a leading role in global investor initiatives on climate change.

The IIGCC has more than 300 members across 22 countries, with over €37 trillion in assets under management.

Masterclasses

Scientific Beta Virtual Climate Masterclass North America

22 June, 2021,10.00am – 2.30pm EST

Scientific Beta is organising a virtual Climate Masterclass exclusively for asset owners and institutional consultants in North America, at which Scientific Beta's experts will examine a number of important issues that need to be considered in the field of climate investing.

At the Masterclass, Erik Christiansen, ESG & Low Carbon Solutions Specialist, Felix Goltz, Research Director, and Eric Shirbini, Global Research and Investment Solutions Director, will discuss the following topics:

• Importance of Climate Investing for Institutional Investors

• What are the consequences for portfolio construction of adhering to these investment frameworks?

• The dangers of mixing up investment concepts, current misconceptions in the area of alpha or ESG and LC factor performance and the true response in the area of risks relating to climate transition

• The devil is in the details. What are the subjects that can make an ambitious ESG investment strategy lack robustness?

• What are the consequences for benchmark construction of taking challenges and difficulties into account in the area of climate investing: the case of pure climate indices?

Further details are available in the programme.

The event is reserved for asset owners and institutional consultants upon receipt of an invitation. Attendance at the event is complimentary but registration is required.

To attend the online Masterclass, please contact Séverine Cibelly at severine.cibelly@scientificbeta.com or on +33 493 187 863.

Webinars

How to be Defensive and Protective of the Environment?

27 May, 2021 – 4.00pm Singapore Time / 10.00 am CEST

Defensive equity should be a serious consideration for multi-asset investors who fear that their current exposure to fixed income is offering very low returns, or are concerned about the performance of fixed income in an inflationary macro environment. We will demonstrate how investors can significantly reduce equity portfolio drawdown while also providing better overall risk-adjusted return through well diversified and robust exposure to the low volatility risk factor.

Traditional defensive solutions based on minimum volatility or low volatility strategies are unfortunately not truly defensive in periods of high market volatility, at a time when lower risk is needed most. To address this volatility risk, Scientific Beta provides a highly defensive strategy through a cost efficient risk control mechanism that harnesses innovations in volatility forecasting that effectively smooth-out the impact of spikes in volatility. This feature provides very strong capital protection compared to more traditional defensive strategies and is a very powerful alternative to fixed income for multi-asset investors.

Traditional defensive strategies also suffer from high carbon exposure compared to a cap-weighted index because these strategies overweight low risk sectors such as utilities which include companies with a high carbon exposure. This high carbon exposes these types of strategies to climate risk. Scientific Beta offers its defensive strategy with a sharp reduction in carbon exposure compared to traditional defensive strategies and cap-weighted indices without sacrificing the defensive properties of the strategy.

To participate in the webinar, please visit the dedicated registration web page.

For further information about this event, please contact Séverine Cibelly at severine.cibelly@scientificbeta.com.

Climate Change – The Devil is in the Details Series #3:

Does a Good Overall Portfolio Climate Score always Correspond to a Positive Strategy for the Climate?

This was the third and final webinar in the "Climate Change: The Devil is in the Details" series, hosted by Erik Christiansen, ESG & Low Carbon Solutions Specialist, and Frédéric Ducoulombier, ESG Director, at Scientific Beta, on 4 February, 2021.