Unsustainable Proposals

By failing to represent investors' interests and through its deficiencies, the proposal for the new European regulation on sustainable benchmarks is not the right answer to climate transition. In a comprehensive analysis of the recent proposals from the Technical Expert Group (TEG), which the European Commission mandated to assist it in drawing up delegated acts implementing the Regulation on Climate Benchmarks and Sustainability Disclosures of Benchmarks (2019/2089), Scientific Beta underlines that these proposals go against the legislator's goal of an ambitious reorientation of investment flows in support of climate transition and sustainability.

The November 2019 update of the European Benchmark Regulation creates official labels for Climate Benchmarks and requires that benchmark statement and methodology include explanations of how Environmental, Social and Governance (hereafter "ESG") dimensions are reflected when a Benchmark pursues ESG objectives. The EU Climate Transition and Paris-aligned Benchmarks labels aim to harmonise and improve transparency of the climate change index market at the EU level and to combat misleading claims as to the environmental credentials of investments, or "greenwashing". The introduction of disclosure requirements with respect to ESG incorporation into Benchmarks is intended to facilitate cross-border comparisons and help market participants make well-informed choices.

In this context, the legislator has empowered the European Commission (hereafter "the Commission") to adopt delegated acts to specify minimum standards of index construction for EU Climate Benchmarks and to lay out the minimum contents of explanations about ESG incorporation and their standard format for Benchmarks pursuing ESG objectives.

The Commission released its proposals on 8 April and is inviting feedback until 6 May. We find these proposals wanting in several material aspects.

As summarised by the Technical Expert Group ("TEG") that advised the Commission, the updated Benchmark Regulation aims to: (i) allow a significant level of comparability of Climate Benchmarks methodologies while leaving administrators with an important level of flexibility in designing their methodologies; (ii) provide investors with an appropriate tool that is aligned with their investment strategy; (iii) increase transparency on investors' impact, specifically with regard to climate change and the energy transition; and (iv) de-incentivise greenwashing (TEG Final Report on Climate Benchmarks and Benchmarks' ESG Disclosures, September 2019).

In respect of the objectives of flexibility and alignment with investor needs (objectives (i) and (ii)), we conclude that the overly prescriptive nature of the delegated act pertaining to Climate Benchmark requirements and its anchoring on broad-universe capitalisation weights considerably reduces the flexibility of administrators to provide investors with Climate Benchmarks aligned with the diversity of their investment strategies. While there is no doubt that Climate Benchmark versions of broad-universe capitalisation-weighted indices would be important tools for investors, index-based investment strategies have traditionally included sector indices and have diversified considerably over the last 15 years. For Climate Benchmarks to have the widest relevance allowed by the Regulation, the diversity of index-strategies should be respected in the delegated acts. In this regard, we feel strongly that climate-conscious investors should not be corralled into one particular class of indices or excessively restricted by implicit methodological options. Ensuring flexibility and alignment with investor needs would also contribute to combatting greenwashing (objective (iv)) by enhancing the scope of effective control exercised over the quality of the claims made by administrators in respect of the climate characteristics of their products.

To avoid narrowing the scope of the Regulation, we thus recommend that Climate Benchmarks retain full flexibility in respect of sector exposures while being required to achieve a high level of decarbonisation in a manner that controls for any sector effects. Specifically, we recommend that the targeted level of decarbonisation be achieved through intra-sector security selection and weighting choices. Doing so prevents the gaming of decarbonisation by cross-sector reallocation, which the TEG proposal encourages and which in our view constitutes greenwashing (incompatible with objective (iv)). We also recommend that the respect of the decarbonisation target of an index strategy be assessed in relation to its non-decarbonised version rather than the market benchmark. Concerns about the risks of confusion and misleading claims about the extent of decarbonisation could be assuaged by appropriate disclosures, e.g. by requiring that decarbonisation be reported relative to the market benchmark.

With respect to the objective of enhanced transparency on Climate Change impact (objective (iii)), we note that the carbon metric put forward in the proposal is an exposure metric rather than a measure of indirect contribution to Climate Change through financed emissions, i.e. a carbon footprint in a strict sense. We recognise however that the self-decarbonisation constraint included in the proposal, whereby the Benchmark metric must fall by 7% year after year, promotes continued reduction in financed emissions and we admit that there are considerable benefits to using carbon metrics that have achieved wide acceptance such as the standard version of WACI.

However, we have grave reservations about the novel "carbon intensity" measure introduced by the proposal. At the very least, this innovation appears counterproductive with regard to the investments already made by concerned parties in the education of the investment management industry and the wider public and in the design of relevant investment products and solutions. We strongly feel that the introduction of novel metrics should be supported by both academic and cost-benefit analyses documenting their superiority over those metrics that have achieved a wide consensus. We also find that even casual observation of the proposed metric is sufficient to reveal multiple flaws.

Particularly problematic is the fact that the volatility the metric imports from equity market values makes it incompatible with the self-decarbonisation requirement, which controls for price inflation but fails to consider the possibility and consequences of market downturns. This is richly illustrated by the recent spike in "carbon intensity" of products that were launched precipitously to comply with the standards being developed. We understand that the proposed metric implicitly targets the coal industry whose capitalisation may be depressed by the prospect of stranded assets. However, the consequences of this tweaking have not been thought through and the regulator would be well advised to backtrack on this half-baked proposal. Where the regulator feels a sector should be subjected to divestment, it should simply require it explicitly to avoid unintended and detrimental consequences from indirect targeting (why should other sectors with depressed capitalisations be made to suffer and those with rich multiples be advantaged?). Since coal divestment is already an uncontroversial dimension of decarbonisation for most investors, one may object that the unneeded subsidy to coal divestment hidden in the metric allows less ambitious decarbonisation programmes to meet the requirements for qualification as Climate Benchmarks.

Another key issue with the metric upon which the proposal relies for assessing decarbonisation is its direct consideration of value-chain indirect ("Scope 3") emissions, which by the very admission of the TEG will not be fit for the purpose of stock selection "for the foreseeable future." As these emissions are larger than the sum of direct ("Scope 1") and energy-related indirect ("Scope 2") emissions by an order of magnitude in most sectors, their combination will drown out any corporate-level signal present in Scope 1-2 emissions in a sea of noisy product and activity-based Scope 3-estimated emissions. Unless one wishes to cynically disregard efforts made by companies in the mitigation of their greenhouse gas emissions, we recommend the consideration of Scope 3 emissions be done indirectly via related metrics that can support security-level analysis.

For the above reasons, we strongly recommend that the standard version of WACI (i.e. that with Scope 1+2 as the numerator and revenues as the denominator of constituent-level carbon intensities) be used for assessing decarbonisation as well as for reporting, which is in line with the recommendations of the Taskforce on Climate-related Financial Disclosures.

The proposal of the TEG also dramatically fails to enhance transparency and enable market participants to make well-informed choices when it comes to the incorporation of ESG factors into Benchmarks.

Instead of specifying how explanations on the incorporation of ESG factors should be provided as per the terms of the amended Regulation, the delegated act pertaining to benchmark statement disclosures presents long lists of ESG indicators to be computed and disclosed (over 20 for equity indices). That such extensive ESG disclosures would create significant administrative costs and material data licensing costs for Benchmark administrators as well as harm competition in the industry does not appear to be a major concern for the Commission. Interestingly, the composition of the working group that advised the Commission is skewed towards ESG data and service providers that stand to benefit from the proposal. We observe however that the proposal modifies the nature of the Benchmark statement and entails material costs for Benchmark administrators (and indirectly end-users); for either reason, it may be viewed as beyond the acceptable scope of the legislative delegation enjoyed by the Commission.

To add insult to injury, the overall informational potential of these "minimum" disclosures is low. Indeed, a material share of the mandated quantitative disclosures is in respect of metrics – ESG ratings – whose divergence frustrates the possibility of meaningful comparisons across providers and that have serious theoretical limitations as indicators of ESG performance or risks. Many of the other mandated disclosures are insufficiently standardised to support meaningful uses by investors.

We consider it critical that any indicator that is considered for inclusion into minimum disclosures beyond what is strictly required under the amended Regulation not only be theoretically relevant but also be specified and implemented in a manner that allows for meaningful comparisons across Benchmarks. In addition, the potential benefits of additional disclosure requirements should be balanced against the administrative and data procurement costs that they would create. By keeping mandatory disclosures reasonable and taking steps to minimise their cost, the Regulator would mitigate disincentives to the offering of Benchmarks pursuing ESG objectives and encourage voluntary reporting on the same bases.

In light of the above, it is critical that ESG ratings not be given regulatory endorsement and that they remain excluded from minimum disclosures. To be informative, quantitative disclosures in respect of ESG factors should be focused on exposure to desirable or controversial activities precisely defined and highly standardised. To keep cost inflation in check and ensure perfect comparability, the list of indicators should be as short as possible and an administrative body should be tasked with maintaining a public list of compliant and non-compliant issuers.

The above editorial updates and summarises the analyses and proposals of the advice given by the Technical Expert Group on Sustainable Finance as detailed in the following White Paper:

![]()

Unsustainable Proposals: A critical appraisal of the TEG Final Report on climate benchmarks and benchmarks' ESG disclosures and remedial proposals, Scientific Beta publication, February 2020

Has Your Value Definition Just Expired?

Many index providers claim that the book-to-price ratio is no longer a sufficient descriptor of the value factor. They argue that it has become outdated because reported book value ignores investments into intangible assets. As a solution, they propose including other valuation ratios, such as earnings-to-price, sales-to-price, cash flow-to-price or dividend yield. However, this solution overlooks a superior alternative: intangible capital can be estimated and added to the book value. We compare these alternative solutions and show that including unrecorded intangibles in the book value increases the value premium and aligns with risk-based explanations. By contrast, other valuation ratios do not add investment value beyond picking up implicit exposure to factors other than value. Such valuation ratios also fail to improve the alignment of value strategies with risk-based explanations.

Index providers increasingly question whether book-to-price provides a suitable definition of the value factor. They argue that intangible assets such as brand capital and technological know-how play an increasing role, but are not recognised in reported book values.

Many providers prefer combining several accounting ratios to define value. They argue that a composite of valuation measures using earnings, sales or cash flows will be better able to capture the true value of a stock. Such an approach builds on the insights found in Graham and Dodd (1934). This prominent book on "security analysis" provides guidance to stock-pickers on how to identify securities that are underpriced relative to their intrinsic value. A common misunderstanding of the value factor is that its definition provides a measure of intrinsic value that can be used to identify underpriced stocks.

Of course, a combination of accounting metrics does not infallibly reveal the true value of a stock. As illustrated in Exhibit 1, we can derive from first principles that – even if they are valued fairly – different firms may have discrepant accounting ratios, depending on their growth prospects and risk. Likewise, undervalued and overvalued firms may have identical accounting ratios. Valuation needs to account for investors' growth expectations and risk perceptions. Financial accounts and even analyst forecasts do not provide sufficient information. More generally, if true value could be extracted from financial and market data, there would not be an armada of active managers working hard to identify underpriced stocks.

Exhibit 1: True Value in a Dividend Discount Model

True Value in a Dividend Discount Model |

|||

Book Equity |

100 |

Required Rate of Return |

10% |

ROE |

10% |

Earnings |

10 |

Payout Ratio |

50% |

Dividends |

5 |

Scenario 1 |

Firm 1 |

Firm 2 |

Firm 3 |

Growth Rate |

6% |

5% |

4% |

Market Price |

125.00 |

100.00 |

83.33 |

True Value |

125.00 |

100.00 |

83.33 |

B/P |

0.80 |

1.00 |

1.20 |

E/P |

0.08 |

0.10 |

0.12 |

D/P |

0.04 |

0.05 |

0.06 |

Scenario 2 |

Firm 1 |

Firm 2 |

Firm 3 |

Growth Rate |

6% |

5% |

4% |

Market Price |

100.00 |

100.00 |

100.00 |

True Value |

125.00 |

100.00 |

83.33 |

B/P |

1.00 |

1.00 |

1.00 |

E/P |

0.10 |

0.10 |

0.10 |

D/P |

0.05 |

0.05 |

0.05 |

This table provides a stylised illustration to show that simple accounting ratios should not be expected to capture the true value of a stock. Three firms, which only differ in their expected future growth rate, are placed in two scenarios. The first scenario assumes that the market prices firms correctly, the second scenario allows for under- or over-valuation. The resulting accounting ratios are presented accordingly.

Identifying true value is more an art than a science and best left to active managers. The value factor was never meant to provide a view on securities valuation and does not require true values as an input. Instead, factor investing builds on insights from asset pricing that have identified patterns in the cross-section of expected returns. Exposure to the value factor captures differences in expected returns across stocks that reflect compensation for risk.

While they may not have higher volatility or higher market beta, value stocks tend to produce losses in bad times, when marginal utility of consumption is high. Investors need to be compensated for holding such risk.

Academic research has identified a detailed economic mechanism that leads value firms to suffer in bad economic times. Such firms' value is mainly made up of assets in place – rather than growth options. If assets in place are costly to reverse, such firms cannot adapt easily to reduced output in bad economic times. The value of growth firms, on the other hand, mainly consists of growth options. Such firms can delay their growth options flexibly without incurring high costs. This leads value firms to suffer more in bad economic times. Investment patterns observed for listed firms confirm that downward adjustments of a firm's capital stock are indeed more difficult than upward adjustments, and such differences help explain the value premium.

From this perspective, omitting intangible capital in the book value is problematic if it contributes to risk like physical capital does. If intangible capital is costly to reverse, holding a large stock of intangible capital may increase a firm's risk and lead to compensation for stockholders. Empirical research has shown that investment into intangible capital increases systematic risk and is indeed costly to reverse.

Intangible capital also exposes firms to shocks in financing conditions in the economy. For example, firms which rely on specialised know-how are exposed to a risk of key talent leaving the firm. Such talent dependency increases the risk exposure of firms to financing constraints, as key talent will tend to leave financially constrained firms when financing conditions deteriorate. Similarly, highly innovative firms may have to abandon R&D projects under financial stress, leading to additional losses in bad times. More generally, firms cannot use intangible assets as collateral, exposing them to a risk of tighter financing constraints in bad economic times.

There is a simple answer to the problem that reported book value excludes intangible assets: we can adjust book values to include unrecorded intangibles. The academic literature has established measures of intangible capital. Rather than dismissing book-to-price as outdated, we can update how it is measured by including intangible capital in the book value.

Economists recognised early on that intangible capital is a crucial part of firms' capital stock. In addition to physical capital (property, plant and equipment), firms invest in knowledge capital and organisation capital. Knowledge capital is created through research and development (R&D) that leads to know-how in the form of patents, improved processes, and better product quality. Organisation capital is created through investment in training, advertising and organisational design and leads to a skilled workforce, brand recognition, and customer relationships.

It follows that a standard approach to measuring intangible capital uses data on reported expenses that represent investments in this capital. In particular, R&D expenses can be reinterpreted as investment into knowledge capital, advertising expenses as investment into brand capital, and part of overheads (selling, general and administrative expenses) as investment into organisation capital.

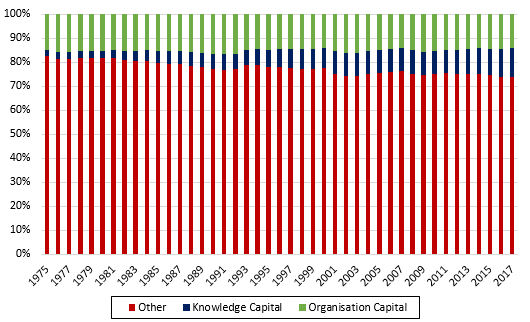

Intangible capital represents a significant portion of firms' total capital. Exhibit 2 shows the average size of knowledge and organisation capital relative to total capital across the broad U.S. stock market. These intangible assets represent on average around 20% of total capital. Consequently, omitting them might have a material impact. There is also some support for the increasing importance of intangible assets in recent years. This is driven by a strong rise in the proportion of knowledge capital, from 3% in 1975 to 12% in 2017. The proportion of organisation capital has fluctuated around 15% throughout the past decades.

Exhibit 2: Proportion of Omitted Intangible Capital

The graph shows the average percentage of knowledge and organisation capital in total capital across firms in the broad Compustat universe. The data is based on accounting statements for fiscal years ending between January 1975 and December 2017. Data source: Compustat.

Recent research1 conducted by Scientific Beta assesses an intangible-adjusted book-to-price factor and compares it to other valuation ratios. Exhibit 3 shows the various alternative value proxies compared in the study. In light of the previous discussion on the discrepancy between security valuation and the concept of the value factor, a clear dichotomy arises. On the one hand, the use of the book-to-price or the intangible-adjusted book-to-price ratios is supported by the rationale of costly reversibility of assets in place. On the other hand, valuation ratios such as earnings- or cash flows-to-price do not have a clearly identified link with the risk of value stocks. Instead, the use of these proxies is grounded in the ideas of securities valuation.

Exhibit 3: Overview of the Alternative Value Proxies Tested

Alternative Value Proxy |

Adjustment |

Book-to-Price (B/P) |

The book-to-price ratio as proposed by Fama and French (2018) |

Adjusting the Book Value for Intangibles |

|

Intangible-adjusted book-to-price (iB/P) |

Add knowledge and organisation capital to the book value, while deducting goodwill |

Using Other Valuation Ratios |

|

Sales-to-price (S/P) |

Replace book value by sales |

Earnings-to-price (E/P) |

Replace book value by earnings |

Dividend yield (D/P) |

Replace book value by dividends |

Cash flow-to-price (CF/P) |

Replace book value by cash flows |

Composites |

|

Composite of S/P, E/P, D/P and CF/P |

Average of the z-scores of the individual metrics |

Composite of B/P, S/P, E/P, D/P and CF/P |

Average of the z-scores of the individual metrics |

Exhibit 4 gives a brief overview of the performance of these alternative value factors. We find that the intangible-adjusted book-to-price factor produces a particularly strong premium of 4.8%, compared to 2.2% for the standard value factor. However, most of the alternative proxies lead to higher value premia compared to the standard book-to-price definition.

Exhibit 4: Factor Performance

Factor Performance |

B/P |

iB/P |

S/P |

E/P |

D/P |

CF/P |

Comp. exc. B/P |

Comp. inc. B/P |

Ann. Absolute Return |

2.21% |

4.82% |

4.20% |

2.95% |

-0.28% |

2.77% |

2.66% |

2.50% |

P-value |

0.08 |

0.00 |

0.00 |

0.03 |

0.90 |

0.04 |

0.05 |

0.07 |

Ann. Volatility |

9.77% |

7.93% |

9.04% |

10.74% |

9.75% |

10.27% |

10.93% |

11.19% |

Sharpe Ratio |

0.23 |

0.61 |

0.46 |

0.27 |

-0.03 |

0.27 |

0.24 |

0.22 |

Max. Drawdown |

44.44% |

28.66% |

48.83% |

54.94% |

50.08% |

50.93% |

55.39% |

56.43% |

The table shows the standalone performance measures for alternative value factors. The value factors are based on the value scores described in Exhibit 3. The time period of the analysis is July 1976 to December 2018. Data source: CRSP, Compustat, K. French database.

More important than the standalone performance, the strong premium for the intangible-adjusted book-to-price factor remains significant when accounting for exposures to other factors, at 2.09% per year. The intangible adjustment thus improves investment outcomes for multi-factor investors. For an investor who held exposure to six factors, including intangibles in the book-to-price factor increased the Sharpe ratio by more than 10% historically.

The intangible-adjusted book-to-price factor also aligns closely with the risks of the standard book-to-price factor. This alignment with a risk-based explanation is important for investors who are trying to capture a premium that will likely persist, even when it becomes widely known. The intangible-adjusted value factor leads to cyclical variation in market betas and earnings. Value stocks with high book-to-price also have higher operating leverage than growth stocks with low book-to-price when we adjust for intangibles. These observations all show that value stocks are riskier than growth stocks.

Using alternative valuation ratios does increase returns compared to book-to-price. However, this improvement is explained by implicit exposures to other factors, such as quality and low risk. When adjusting for multiple exposures, the premium of a composite value factor is not distinguishable from zero, at -0.41% per year.

It is not a surprise that some of the alternative valuation ratios result in a tilt to other factors. In particular, using earnings or cash flows results in a strong tilt towards the profitability factor. Highly profitable firms generate high earnings and will also tend to have high cash flows. Consequently, these alternative value factors lead to increased overlap with the profitability factor.

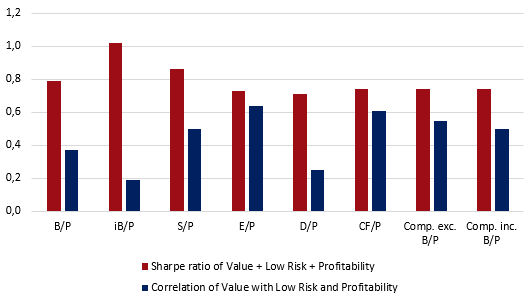

Changing from book-to-price to other valuation ratios or composites reduces the Sharpe ratio of multi-factor portfolios due to this factor overlap. Exhibit 5 illustrates this point. The red bars show the Sharpe ratio of a portfolio containing the value, low risk and profitability factors. The blue bars show the correlation of the value factor with the other two factors. Switching to other valuation ratios such as earnings- or cash-flows-to-price increases correlation with the other factors in the portfolio and reduces the Sharpe ratio. The opposite is true for the intangible adjustment, which results in a decreased correlation and an increased portfolio Sharpe ratio.

Exhibit 5: Performance of a 3-Factor Portfolio

The graph shows the Sharpe ratio of a portfolio consisting of the value, low risk and profitability factors and the correlation of the value factor with the other two factors. The value factors are based on the value scores described in Exhibit 3. The time period of the analysis is July 1976 to December 2018. Data source: CRSP, Compustat, K. French database, AQR.

Combining various valuation metrics is an old recipe from the 1990s. Back then, investors did not have access to other factors, such as quality and low risk. But investment practices have changed. Many investors now hold portfolios that combine multiple factors. Therefore, picking up implicit exposure to other factors in a composite value definition does not improve investment outcomes.

Such composite value definitions may indeed be approaching their expiration date. Book-to-price on the other hand is still looking fresh, especially when unreported intangible capital is included.

Footnotes:

1”Intangible Capital and the Value Factor: Has Your Value Definition Just Expired?”, Scientific Beta white paper.

![]()

Intangible Capital and the Value Factor: Has Your Value Definition Just Expired?, Scientific Beta white paper, February 2020

Does Recent Performance of Standard Factors Justify a Factor Zoo? Comment on the Conclusions from Blitz (2020)

This short research piece provides a comment on a paper by Blitz (2020) who analyses factor performance and concludes that his "findings question the classic ambition of the asset pricing literature to reduce the entire ‘factor zoo’, i.e. the hundreds of alleged factors, to just a handful of factors that should explain the entire cross-section of stock returns. Although the Fama-French factors still have a strong long-term performance, they have by now experienced two lost decades during which various other factors were able to deliver. Thus, it seems that more factors are needed for an accurate and comprehensive description of the cross-section of stock returns".

Do we really need a factor zoo?

Blitz (2020) makes a claim that is common among active factor managers: you need many and possibly “enhanced” factors rather than a handful of standard ones. Poor recent performance of standard factors in combination with good performance of other, non-standard factors is cited as a support for this claim. However, that standard factors do not have positive returns over a given period is not a new finding. We have seen this with poor performance of value, size and low volatility in the late 1990s for example. It is what you would expect from looking at historical data for factor returns prior to 2010. The same finding holds for the equity premium, which may not be positive over extended periods of time.

The empirical analysis is also extremely simplistic. Blitz (2020) downloads factor return series from academic websites and simply computes returns over calendar decades. If this was a homework handed in by a student in an introductory portfolio management course, we would be disappointed. As a basis for criticism of the asset pricing literature, such an analysis is insufficient.

The argument that investors need different factors because the standard ones have not delivered performance over the past ten years is extremely misleading. After all, investors making decisions today require factors that perform over the next ten years, not the past ten years.

Factors do not aim to provide an accurate description of return patterns over any short time period. Instead, they are supposed to indicate sources of long-term returns. Blitz’s conclusion reflects a misunderstanding of the goals of asset pricing research and the corresponding applications in factor investing.

The remainder of this article provides further discussion of the shortcomings of the arguments in Blitz (2020).

Searching for many factors will likely result in spurious findings

The paper implies that a factor model should provide a precise description of stock returns, by stating that "more factors are needed for an accurate and comprehensive description of the cross-section of stock returns". However, the asset pricing literature does not aim to describe the cross-section with the greatest accuracy for a short sample spanning a decade. Instead, asset pricing theory tries to come up with factors that are related to long-term differences in returns and have a sound economic rationale why such patterns should persist going forward. Unsurprisingly, such factors are few. By allowing for a greater number of factors and by trying to explain more detailed price movements over short time periods, the risk of wrongly identifying spurious patterns in the data as factors increases sharply. This is why a proliferation of factors should be avoided.

Consequently, investors who wish to apply the insights from asset pricing research and benefit from factor premia need to emphasise robustness when selecting a set of factors. Harvey et al. (2016) document a total of 314 factors with positive historical risk premia and show that the discovery of the premium could be a result of data-mining. Spurious return patterns can be misidentified as statistically significant factors as long as enough researchers are searching through the same dataset. The practice of identifying merely empirical factors is known as factor fishing (see Ang, 2014; Cochrane, 2001). Therefore, a key requirement of investors to accept factors as relevant in their investment process is that there is clear economic intuition as to why the exposure to this factor constitutes a systematic risk that requires a reward, and why it is likely to continue producing a positive risk premium (Kogan and Tian, 2013). In short, factors selected just on past performance without considering any theoretical evidence are not robust and must not be expected to deliver similar premia in the future. This is emphasised by Harvey (2017), who argues that "economic plausibility must be part of the inference".

In another recent study, Chordia et al. (2017) also emphasise the factor fishing problem. They show that it is easy to find great new factors in backtests that add no real value to standard factors. They create more than two million factors based on levels, growth rates or ratios from 156 accounting variables and assess whether these factors add value beyond the value, momentum, profitability, investment, size and market factors. While they find no fewer than 22,337 great factors, the winning factor definitions do not make any economic sense. For example, it is hard to imagine why the ratio of common stock minus retained earnings to advertising expense should explain the cross-section of returns. These factor definitions also fail to survive vetting which considers multiple testing biases. In fact, from more than 20,000 factors that appear significant, none survive after adjusting for the well-known standard factors and multiple testing biases.

Hou et al. (2017) shed some light on the potential prevalence of factor fishing in practice. This paper tries to replicate a set of 452 asset pricing anomalies, which had been identified in previous studies. The authors conclude that the majority of these results fail to replicate. This finding highlights the risk that calling for more factors entails. It emphasises that it is easy to discover new factors in the data if enough fishing is done, but they will be neither economically meaningful nor statistically robust. In other words, they will not be useful for investors going forward.

A simplistic analysis that lacks rigour does not lead to meaningful conclusions

Conclusions regarding the need for more factors should follow from a rigorous empirical analysis. Blitz (2020) only presents standalone factor returns per calendar decade. These results are far from sufficient to make any meaningful conclusion for three main reasons. First, looking at calendar decades is a very specific choice and can influence results. Second, there is no indication whether results are statistically significant. Third, these results do not take into account the correlations between factors.

As indicated in the paper, the pre-2010 returns of the Fama-French factors suggest a 20% probability that the factors have a negative average performance over a decade. Including the most recent decade increases this probability to 33%. However, it is also pointed out that using 10-year rolling returns reduces this probability to 1.6%. Clearly, conclusions regarding factor performance are extremely sensitive to the starting dates of the individual decades. Furthermore, the choice of a 10-year window is also arbitrary. Using for example a 5-year window may give results that look different. Still, the author relies on these results to make his conclusions.

The paper only focusses on the levels of factor returns. It is intuitively clear that average returns in a sample period will be an unreliable indication of an asset’s long-term average returns if the asset is highly volatile. In this case, there is a high chance that the particular outcome observed is sample-specific. To take this risk of obtaining sample-specific results into account, research results are usually presented together with their statistical significance levels. Ideally, the interpretation of these levels also takes into account the amount of tests performed. The lack of significance levels in the paper, however, means that we are not able to assess whether results are likely sample-dependent or not.

The third shortcoming in the empirical analysis is that it focusses on standalone factor returns. As pointed out by Esakia et al. (2019), the investment implications of asset pricing research can be influenced by this. They show that the contribution of factors to the Sharpe ratio of a multi-factor portfolio is not necessarily in line with their standalone returns, because some factors are more highly correlated with each other than others. Describing a very rough relationship between the standard and non-standard factor returns based on calendar decades of standalone returns is not enough to say something meaningful about the correlations between the factors. To properly conclude that more factors are needed, it is necessary to explicitly account for the exposures to standard factors.

Expanding the set of factors does not benefit investors

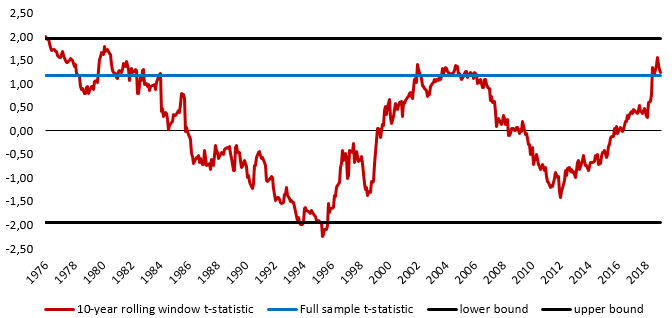

The graph below illustrates how the results look when taking into account the three considerations mentioned above. It shows the performance of an investment in an equally-weighted portfolio of the 13 ‘other factors’ in the Hou-Xue-Zhang q-factors data library1, as defined by Blitz (2020)2. These 13 factors are themselves already aggregated, consisting of 49 underlying factors. The results thus give an idea of the performance that an investor could have achieved by considering a broad set of potential factors.

Instead of limiting the analysis to results based on calendar decades, we present results for both the full sample (blue line) and for rolling 10-year windows (red line). The use of rolling windows provides a more complete picture of the various performances investors would have experienced over 10-year periods with different starting points. Next, the results are presented as t-statistics instead of returns, which makes it possible to interpret the results in light of their statistical significance. Finally, we explicitly control for exposures to the factors proposed by Hou et al. (2020), and consequently assess the alphas from a spanning regression. Their q5 factor model3 reduces the factor zoo of the 49 factors in the investor’s portfolio to only 5 factors.

The graph gives a clear picture. The added value that an investor can obtain by investing in a broad set of factors, as opposed to sticking to a more limited set of 5 factors, is not significant. Over the full sample, the value of the alpha is well within the conventional significance bounds. The rolling alphas fluctuate around zero over time, which is in line with the non-significance of the full sample result. Any outperformance that is observed over a specific 10-year period is likely sample-specific. Hence, for investors who want to harvest return premia of long-term rewarded factors going forward, there is no clear case to expand the number of factors in their portfolio beyond a limited set of standard factors.

Figure 1: Added Value of a Broad Set of Factors over the Factors in a Standard Model

Conclusion

For investors, fishing for factors that have won in the past does not add value. Instead, investors benefit from focusing on finding factors that are supported by sound theory and empirical evidence. There is a limited number of such factors, which have passed the high hurdle of peer-reviewed assessment and scrutiny in the academic literature. An ad-hoc analysis of short term performance that does not even pass the mildest standards of research quality is not suitable to question the broad evidence on factors.

Footnotes:

1http://global-q.org/index.html.

2Blitz (2020) aggregates individual factors based on the various decile portfolios available in the data library in the following 13 composite factors: Size, Value, Payout yield, Profitability, Accruals, Investment, Intangibles, Price momentum, Analyst revisions, Earnings momentum, Seasonals, Short-term reversal and Low-risk.

3Data for these factors also come from the Hou-Xue-Zhang q-factors data library, where they are constructed from 1972 onwards by Hou, Xue, and Zhang (2015), extended back in time by Hou, Mo, Xue, and Zhang (2019) and augmented with expected growth by Hou, Mo, Xue, and Zhang (2020).

Assessing the Robustness of Smart Beta Strategies

Concerning actual investment decisions, assessing the robustness of smart beta strategies should play a central role for investors in their due diligence process. Such strategies often experience an out-of-sample degradation of their performance compared to that presented in the historical in-sample period. Investors should always check that interesting in-sample results are complemented by a consistent construction framework and transparency on the methodology and implementation from the side of the strategy provider. This evaluation of the robustness by design needs to be completed by an empirical analysis. This article describes the sources of a lack of robustness in the design of the indices and explains the need for robustness checks in performance analysis of such strategies and the various methods by which Scientific Beta improves robustness.

As a complement to this analysis of the robustness of the construction method of smart beta strategies, investors should also be able to measure robustness directly using appropriate tools and metrics in order to cross-check whether the strategy's behaviour is consistent with its stated objective. However, assessing the robustness of a strategy based on historical simulations can become challenging due to sample dependence. For this reason, we discuss appropriate measurements of robustness and describe the robustness protocol that we employ to evaluate the robustness of strategies under scrutiny. This toolkit of robustness tests is quite relevant to investors and can be used in their evaluation of smart beta strategies.

1. Robustness issues in the design of factor strategies and how to improve robustness

In this section, we explain what we mean by robustness in the design of factor strategies. A strategy is assumed to be 'relatively robust' if it is able to deliver similar outperformance under similar market conditions by aligning well with the performance of underlying factor exposure it is seeking and reducing unrewarded risks. The relative robustness approach applies generally to single-factor strategies. It ultimately involves checking whether the strategy benefits as much as possible from conditions that are favourable to the factors while at the same time limiting its risks of underperformance. 'Absolute robustness' refers to a strategy that is shown to outperform irrespective of prevailing market conditions. This is notably the case for multi-factor strategies, for which it is expected that the multi-factor diversification will allow them to perform whatever the factor conditions.

A lack of robustness in smart beta strategies can be caused mainly by exposure to three different risks in the strategy construction process. Two are sources of a lack of relative robustness, namely factor fishing and factor redundancy as well as non-robust weighting schemes. The third, often referred to as high factor dependencies, generates a lack of absolute robustness.

Scientific Beta proposes three solutions by which robustness of smart beta strategies can be improved.

As an illustration, we provide a list of multi-factor products offered by different providers and we highlight flaws in the robustness of their design (see Exhibit 3).

Finally, we highlight the need for transparency that enables investors to independently verify the performance reported by the providers.

1.1 Sources of a lack of robustness and solutions

Factor fishing risks and factor redundancy – Cause a lack of relative robustness

Harvey et al. (2016) document a total of 314 factors with positive historical risk premia showing that the discovery of the premium could be a result of data mining (i.e. strong and statistically significant factor premia may be a result of many researchers searching through the same dataset to find publishable results). The practice of identifying merely empirical factors is known as 'factor fishing' (see Ang, 2014; Cochrane, 2001). Therefore, a key requirement of investors to accept factors as relevant in their investment process should be that there is clear economic intuition as to why the exposure to this factor constitutes a systematic risk that requires a reward, and why it is likely to continue producing a positive risk premium (Kogan and Tian, 2013).

Among competitor strategies, we see a proliferation of factor definitions (see Exhibit 3). This is a negative sign for investors as these factor choices often depart from the definition of a factor risk premium as documented in academic studies and the economic rationale underpinning their existence. Take for example, the Value factor risk premium. The risk-based economic rationale, which is closely linked to the definition of Value, is the costly reversibility of assets in place. Value companies have a lower P/B ratio since these companies have a higher book value (assets in place) relative to their market capitalisation. The irreversibility of assets in place means that Value companies will be more sensitive to economic shocks in bad times, exposing investors to a risk of losses when their economic situation is already poor, their consumption is low and marginal utility of consumption is high. The risk premium is compensation to investors who are willing to take this additional risk by explicitly tilting towards this factor. Competitor strategies, however, do not rely on this univariate definition of Value as follows by its economic rationale, and instead choose composite multiple-variable definitions or economic proprietary models to define the Value factor. This choice opens the door to higher degrees of freedom in the index design, and higher risk of data mining.

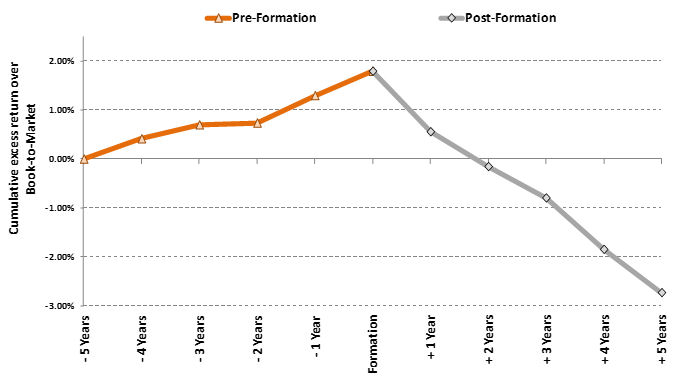

Our analysis below shows that various alternative Value definitions fail to outperform the P/B metric out-of-sample despite their superiority during the in-sample search. Every year between 1984 and 2009, a 5Y formation period is used to pick the best portfolio based on alternative Value definitions and this portfolio is held for another 5 years. Exhibit 1 plots the average outperformance pre- and post-formation with respect to the Book-to-Market portfolio. The chart clearly shows that the average alternative variable definition ultimately underperforms the Book-to-Market and drives the cumulative relative returns way below zero. Picking the past winner yields cumulative outperformance over book-to-market of +1.79% in-sample. However, over the following five years, having picked the in-sample winner leads to an out-of-sample cumulative underperformance of -2.72%. This analysis demonstrates that alternative Value definitions hardly present a suitable replacement for Book-to-Market overall.

Exhibit 1: Comparison of Cumulative Relative Returns of the Average Best In-Sample Alternative Value Strategy with Respect to a Portfolio Based on Book-to-Market

This chart plots the cumulative excess returns of ten annually rebalanced cap-weighted Value tilted strategies with 50% stock selection out of the universe of 500 US stocks based on ten alternative Value strategies, with respect to a similarly constructed portfolio based on Book-to-Market. Between 1984 and 2009, a five year formation period is used to pick the best portfolio based on alternative Value definitions and this portfolio is held for another five years. This is done every year for a total of 26 event studies. The chart plots the average outperformance pre- and post-formation with respect to the Book-to-Market portfolio. The alternative Value definitions are Earnings-to-Price, Cash-flow-to-Price, Sales-to-Price, Dividend-to-Price and Payout-to-Price, both plain-vanilla and sector neutral versions for each. The graph is smoothed by using yearly values.

It becomes clear that factor fishing issues arise from multiple tests of candidate variables where a product provider chooses a single variable among a vast range of candidate variables based on backtested performance. The resulting bias may be referred to as a "selection bias". To make things worse, there is an additional bias that is specific to composite scoring approaches – factor definitions which draw on combinations of multiple variables, such as those widely used by competitor indices. The paper by Novy-Marx (2015) analyses the bias inherent in backtests of composite scoring approaches.1 Novy-Marx argues that the use of composite variables in the design and testing of smart beta strategies yields a "particular pernicious form of data-snooping bias". He shows that creating a composite variable based on the in-sample performance of single variable strategies generates an over-fitting bias. To make matters worse, this over-fitting bias interacts with the selection bias. The presence of both biases in composite variable smart beta strategies increases the data mining problems exponentially.

The same issue arises with the definition of a Quality factor. The academic literature has proven that two distinct factors exist under the umbrella of a Quality definition, namely the High Profitability and Low Investment factors. Quality factor propositions, however, do not make this distinction and instead rely strongly on composite variable definitions – in one competitor case, even 10 variables are combined. This leads to Quality portfolios comprising of 'grey' stocks, i.e. stocks that do not offer exposure to either of the two well-rewarded factors.

To illustrate such risks of using non-standard factors, Exhibit 2 shows the factor exposures and performance attribution of the excess returns of the MSCI World Quality Index. This index is based on a non-standard composite Quality factor definition. It is interesting to assess how this index is exposed to the two standard quality factors in the academic literature, Profitability and Investment. The exposure to Profitability is clear with a beta of 0.39. However, the exposure to the Investment factor is around zero. This is contrary to what is expected from a Quality index. Furthermore, the exposures to the Market, Size and Value factors are negative. Obtaining significant negative exposures to factors that are unrelated to Quality is an important, presumably unintended, consequence of investing in this Quality index. The last column shows that only 31.79% of the impact on the excess returns is driven by the Quality factors. This means that non-Quality related factors and idiosyncratic risk are the main drivers of how this index performed relative to the cap-weighted index. This misalignment with investment objectives may be present in any index based on non-standard factor definitions. Hence, proprietary factor definitions lead to a risk of misunderstanding factor exposures.

Exhibit 2: Exposure of Composite Quality Factor Index Excess Returns to Standard Factors

MSCI World Quality Index |

Exposure (beta) |

t-stat |

Performance Attribution |

Impact on Performance |

Ann. Alpha |

0.01 |

1.75 |

0.96% |

30.04% |

Market |

-0.06 |

-8.82 |

-0.47% |

14.65% |

Size |

-0.20 |

-12.15 |

-0.29% |

9.18% |

Value |

-0.26 |

-13.49 |

-0.31% |

9.69% |

Momentum |

0.04 |

4.79 |

0.15% |

4.64% |

Profitability |

0.39 |

15.01 |

1.01% |

31.67% |

Investment |

0.00 |

-0.14 |

0.00% |

0.12% |

R2 |

64.06% |

Total |

1.04% |

100.00% |

The analysis is based on weekly return data for the period starting on 20 June 2002 and ending on 30 June 2018. The first two columns show the regression betas together with their t-statistic. The third column shows how much of the annualised excess return of the index can be attributed to the different factors based on their average returns and the exposures. The last column shows the relative size of the impact each of the factors had on the index excess returns, calculated as the absolute value of its performance attribution divided by the sum of the absolute values of the performance attributions. Data source: Bloomberg, French data library.

Alternative or new factor definitions may also be redundant with respect to consensus factors from the academic literature. In fact, many proprietary factors may have return effects, which can be explained away by the fact that they have exposures to standard factors (see Fama and French, 1996). Popular factor products and tools contain a large number of factors that do not deliver an independent long-term premium. This is bad news for investors who are using such tools to understand the long-term return drivers of their portfolios.

The Dividend Yield is a characteristic example of a redundant factor and is employed in competitor products. Our analysis shows that the Dividend Yield factor does not lead to significant returns (see also an extensive analysis in Amenc, Goltz and Luyten, 2020). Moreover, when adjusting returns for the exposure to the standard Value (book-to-market) effect, the Dividend Yield factor actually delivers negative returns.

A common theme that we observe across most factor providers is that of creating different products over time that end up with inconsistencies in the construction and factor choices. This common practice increases risks for investors (data-mining risks in particular), a topic that we have thoroughly discussed in our white paper "Inconsistent Factor Indices: What are the Risks of Index Changes?".

Assume we take MSCI as an example and the two multi-factor indices offered to investors (see Exhibit 3). The MSCI USA Diversified Multiple-Factor product targets four factors and excludes Low Volatility. However, the missing Low Volatility factor is otherwise offered as an individual product and is also part of the second multi-factor index, MSCI USA Factor Mix. The latter index includes two of the factors (Value, Quality) that are part of the former but further excludes Momentum and Low Size. The inconsistencies in factor choices are obvious. Similarly for FTSE, we see that their first index, FTSE Russell 1000 Comprehensive Factor, targets five factors (Quality, Value, Momentum, Low Volatility and Size) while the second index, FTSE JP Morgan Diversified Factor US Equity, targets three (Value, Momentum and Quality). Methodologies between indices also differ considerably (see Exhibit 3 for a summary), thus increasing inconsistencies further between products of the same provider. From that viewpoint, even though research and the positions taken by major industry players should be guidelines for investors, the increasing number of conclusions and investment beliefs, while allowing these players to ensure, with products that have such contrasting characteristics, that they can always hope to have one that performs well in a particular sample, are to the detriment of the out-of-sample robustness that a long-term investor has the right to expect.

Solution – Avoidance of data mining with a consistent framework. A very effective mechanism to avoid data mining is to establish a consistent framework. Consistency in the index framework prevents model mining by limiting the number of choices by which indices can be constructed. An index that performs well across multiple specification choices is more robust than an index that performs only in a single specification choice, which could very well have been by chance. Scientific Beta uses a consistent smart beta index design framework for the construction of its entire set of smart beta indices known as the Smart Beta 2.0 approach (Amenc, Goltz and Martellini, 2013). In this approach to index construction, a clear separation of the selection and weighting phases is done which enables investors to choose the risks to which they do or do not wish to be exposed. In particular, stock selection is based on robust univariate definitions for a small number of factors that have been academically proven and documented over multiple studies and using long-term data covering different universes and data samples, namely Size, Value, Momentum, Low Volatility, High Profitability and Low Investment.

Lack of robustness of weighting schemes – Cause of a lack of relative robustness

All smart beta strategies are exposed to systematic risk factors but also to strategy-specific risks which are unrewarded in the long run, and therefore not ultimately desired by the investor. Strategy-specific risks give rise to the lack of robustness of weighting schemes. A globally effective diversification weighting scheme reduces the quantity of unrewarded risks such as stock-specific idiosyncratic risks or exposure to risk factors that are unrewarded in the long term, e.g. commodity, currency or sector risks.

A common theme across the suite of products examined (see Exhibit 3) is that these strategies use factor scores as a measure of factor exposure in determining the portfolios. The major drawback factor scores suffer from is "double counting" of exposures, which is due to their lack of regard for the correlation structure of factors. A factor strategy that optimises allocation according to factor scores can easily end up with sizeable negative exposures to most of the other rewarded factors. Concentration will be an additional issue leading to an increase of unrewarded (idiosyncratic) risk taken.

Solution – Avoidance of unrewarded risks. The true Maximum Sharpe Ratio (MSR) portfolio is the only portfolio that contains zero unrewarded risk. Proxies for MSR portfolios suffer from the error associated with the estimation of expected returns. Since academic research has not produced any solution to the problem of expected return estimation – and factor scores are implicit expected return estimates – it is more useful to employ weighting schemes that focus on a robust risk parameter estimation, since extant academic literature proposes numerous approaches to improve statistical estimation of risk parameters. A well-diversified weighting scheme provides efficient access to the risk premia associated with a factor exposure. The idea is to construct an investable proxy for a risk factor while reducing unrewarded risks through the use of a well-diversified weighting scheme.

Strong dependency on individual factor exposures – Cause of a lack of absolute robustness

The economic intuition for the existence of a reward for a risk factor is that exposure to such a factor is undesirable for the average investor because it leads to losses in bad times (i.e. when marginal utility is high, see Cochrane, 2001). Thus, risk factors will have prolonged periods of bad performance and each factor will underperform at different time periods. Therefore, exposure to a single factor is not a robust approach in absolute terms as the investor will be exposed to the risk of underperforming the broad market benchmark when the factor underperforms.

Another common choice across competitor multi-factor products (see Exhibit 3) is the concentration in a few factors among those that are documented to deliver a long-term reward, even if the provider is offering the excluded factors as standalone products. Other competitor strategies even concentrate on a particular factor and control for a handful of others, essentially leading to factor-concentrated products (instead of factor-diversified multi-factor ones).

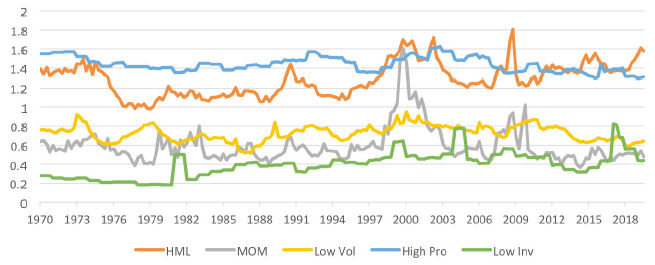

Solution – Avoiding concentration in a single factor. Investors who rely on exposure to a single factor accept the risk that the underlying factor is likely to underperform for short periods. In fact, the reward for exposure to rewarded factors has been shown to vary over time (see e.g. Harvey, 1989; Asness, 1992; Cohen, Polk and Vuolteenaho, 2003). Using smart beta indices as well-diversified ingredients with exposure to the six well-rewarded risk factors, a strong intuition suggests that combining factor tilts, or "multi-beta allocations", will tend to result in improved risk-adjusted performance.

It should be noted that the more a single factor index is concentrated in respect of a given factor, the more likely it is to be poorly exposed to other factors, in particular to those that tend to be antagonistic with the targeted factor (across or in certain market states). In this sense, multi-factor allocations would be detrimental to performance as factor dilution will prevail, cancelling targeted exposures to rewarded factors. Therefore, and in order to diversify the factor allocations well, it is necessary to take account of the cross-sectionalities and the variations in factor intensities between single factor indices. Quite importantly, our High Factor Intensity (HFI) filter integrates the cross-sectional variability of factor intensity over time and across the six well-rewarded factors and offers protection against negative exposure to other rewarded factors in the single factor sleeve construction. These resultant highly efficient single smart factor indices are then appropriate building blocks for a robust multi-smart factor allocation.

Exhibit 3: Design of Competitor Multi-Factor Products

Category |

Methodology |

Factor Definitions |

Weighting Scheme |

FTSE Russell 1000 Comprehensive Factor

|

Bottom-up approach to multi-factor allocations, known to lead to concentrated portfolios. | Value and Quality definitions based on composite variables, known to increase degrees of freedom and introduce data mining risks. | Sequential multiplicative tilts, around market cap weights known to lead to concentrated portfolios. |

| FTSE JP Morgan Diversified Factor US Equity | Sector balanced allocation by inverse sector volatility, but sector not a rewarded risk relative to the benchmark. Arbitrary choice of factors: Targets three factors, while JPM offers five factors as individual products. | Two factors (dividend yield and low volatility) otherwise offered as separate products are sub-components of composite Value (1/4 variables) and Quality (1/10 variables) definitions. Further arbitrary choice to split Quality in three families of the 10 total variables. | Targets higher weight for stocks with higher multi-factor scores – however, stock level characteristics are noisy and expected returns not linear with factor exposure. |

| MSCI USA Diversified Multiple-Factor | Arbitrary choice of factors: Targets four factors, but excludes low volatility which otherwise is offered as an individual product. | Value and Quality definitions based on composite variables, known to increase degrees of freedom and introduce high data mining risks. | Bottom-up optimisation to maximise portfolio alpha score (equal-weight factor score per stock) including multiple constraints. Leads to selection of "grey" stocks that are not exposed prominently to any factor but simply have high average factor exposure. |

MSCI USA Factor Mix

|

Arbitrary choice of factors: Targets three factors, with a mixed selection relative to their Diversified Multi-Factor product (Value, Quality included in both, but now Low Volatility is included instead of Momentum and Low Size) | Proprietary models used in MSCI Minimum Volatility which constitutes a part of this index. | Top-down equal factor allocation which is in contrast with the bottom-up optimisation approach in their Diversified Multi-Factor product. |

| S&P GIVI US | No explicit factor selection, whereby high volatility stocks are excluded and the investable universe of stocks is weighted according to a composite model of Value & Profitability factors. | Proprietary model (Residual Income Model) used to define the intrinsic value for each company, which is then used to weight stocks. The model uses metrics of Value and Profitability factors. | Weighting scheme depends on stock-level factor metrics which are known to be noisy and makes the wrongful assumption that individual stock-level expected returns are proportional to stronger factor measurements. |

| RAFI Multi-Factor U.S. Index | Strong dependence on their fundamental weighting definition (based on four accounting measures related to the Value factor) which underpins universe construction, stock selection and individual factor sleeve weighting. | Value, Quality and Momentum definitions based on composite variables. Low Volatility based on a metric extracted from a multiple regression of stock returns against global, countries and industry groups. Size is not a standalone factor portfolio but rather a multi-factor portfolio of the four other factors in small size universe segment. | Value, Low Volatility, Quality are fundamentally-weighted and carry a strong dependence on a proprietary definition to weight portfolios, while Momentum is cap-weighted which is known to produce concentrated portfolios. |

| RAFI Dynamic Multi-Factor U.S. Index | Same as above, and additionally employs timing of factors based on momentum and reversal signals, while research shows inferiority of factor timing relative to well-balanced multi-factor portfolios. | ||

| AQR Large Cap Multi-Style Fund | Arbitrary choice of three factors: value, momentum and profitability. It is not an index and therefore the methodology is not entirely transparent. | All factor definitions based on composite variables, known to increase degrees of freedom and introduce data mining risks. | Security weighting is discretionary/proprietary with mentions of liquidity concerns. |

| DFA US Core Equity | Claims of exposure to three factors: Size, Profitability and Value. It is not an index and therefore the methodology is not entirely transparent. | Analysis of construction methodology shows that this is a single factor index (Size index) which reduces negative interaction with other two well rewarded factors. | No clear indication of stock weighting mechanism. Size factor is explicitly targeted through stock selection and then stocks with Low Profitability and Growth are eliminated. |

1.2 Importance of transparency

Transparency means the disclosure of at least the index's objectives and its key construction principles, complete information on the calculation methodology, and historical data on constituents and weights. Index transparency is necessary to replicate and validate the track records reported by index providers.

Scientific Beta offers full transparency on its index construction methodology. This is based on unambiguous ground rules, the historical values, constituents and their weights, various performance measures and documentation on how they are computed and long-term track records.

2. Measuring robustness

2.1 Robustness protocol

Measuring the robustness of smart beta strategies is important to have a proper understanding of the stability of their performance and risks in different market environments or under changing assumptions. Therefore, the robustness of strategies should be thoroughly tested before investors implement them. This ensures that investors can understand the performance and risks and know what reasonable expectations for the strategies under different circumstances are. For this purpose, Scientific Beta has developed its own robustness protocol. This protocol covers five main dimensions of robustness:

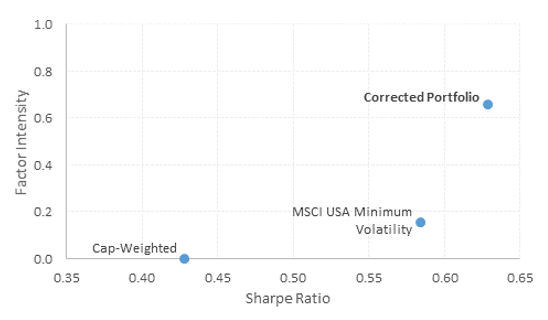

i. Factor Exposure – First, we analyse the risk exposure of the strategy to the market and the six well-rewarded factors2. This is a particularly important robustness check because it allows the investor to measure the factor intensity of a strategy, its factor deconcentration and its factor exposure quality. Factor intensity (sum of non-market factor betas) measures the strength of factor exposures. Factor deconcentration (inverse of the sum of squared relative betas) measures the diversification of factor exposures of a portfolio. If factor exposures are perfectly diversified, i.e. the same exposures to all risk factors, then the ratio is equal to six. Factor exposure quality (product of factor intensity and factor deconcentration) reveals if factor intensity goes hand-in-hand with a more balanced factor exposure. Well-balanced exposures are the key to robustness and this part of the protocol gives you a very good indicator of factor strength and factor diversification quality;

ii. Conditional Performance – Analysing the conditional performance of the smart beta strategies in bull-bear market conditions or under different macroeconomic conditions is a powerful tool in robustness analysis because their performance is shown to depend significantly on macroeconomic state variables (Amenc et al., 2019). We look at the relative performance of smart beta indices under a variety of states, including bull and bear return or volatility periods relative to the market, sectors, factors or macroeconomic variables;

iii. Stability of Performance: Rolling Statistics and Outperformance Probability – Long-run average statistics on risk measures can hide serious fluctuations in these numbers over shorter periods. Therefore, we compute a set of rolling statistics for the strategy. This enables us to assess the stability and the extreme values of these measures. In addition, we compute the Probability of Outperformance, defined as the empirical frequency of outperforming the cap-weighted reference index over a given investment horizon. Its objective is to assess the sensitivity of a strategy's performance to its entry point;

iv. Robust Inference – We also want to know how a new strategy compares to a given benchmark. Simply comparing risk-adjusted returns of the two strategies and concluding that the highest one is reliably better would ignore the fact that we work with only a sample of data and the potential for data mining in the design. To assess whether an observed difference is statistically significant, we conduct a hypothesis test as per Ledoit and Wolf (2008) to test for Sharpe ratio differences;

v. Out-of-sample Tests – Sample specific patterns can always influence the obtained results. Therefore, it is necessary to conduct out-of-sample tests to ensure that the results also hold in different datasets. We calculate and check that the key statistics of interest for a strategy align for a different and longer data sample using our long-term US dataset of more than 45 years length.

2.2 Measuring robustness of multi-factor products

In this part, we employ a battery of tests according to our robustness protocol across the set of multi-factor strategies shown in Exhibit 33. We also add into the analysis the Scientific Beta High-Factor-Intensity Diversified Multi-Beta Multi-Strategy 6-Factor 4-Strategy EW (SciBeta HFI Div MBMS 6F 4S EW) index, including the version with the Market Beta Adjusted (MBA) risk control.

This allows us to quantitatively evaluate if the proposed objectives of these strategies are met in practice, measure their overall robustness and identify the issue of poor factor diversification and factor conditionality observed in these strategies. Instead, we get to see that Scientific Beta multi-factor indices benefit from good factor diversification which reduces conditional dependencies of our strategies and increases confidence for good expected out-of-sample outperformance.

Exhibit 4: Risk Factor Exposure of Competitor and Scientific Beta Indices

10 years

to 31-Dec-2019, in USD |

FTSE Russell 1000 Comprehensive Factor

|

FTSE JP Morgan Diversified Factor US Equity

|

MSCI USA Diversified Multiple-Factor

|

MSCI USA Factor Mix

|

S&P GIVI US

|

RAFI Multi-Factor U.S. Index

|

RAFI Dynamic Multi-Factor U.S. Index

|

DFA US Core Equity

|

Average of Competitors |

SciBeta HFI US MBMS 6F 4S EW |

|

Standard |

MBA (Overlay) |

||||||||||

Unexplained |

0.99% |

0.19% |

0.37% |

0.19% |

-0.02% |

-0.13% |

-0.02% |

0.19% |

0.22% |

0.23% |

0.46% |

Market |

0.94 |

0.91 |

1.01 |

0.90 |

0.90 |

0.96 |

0.97 |

1.06 |

0.96 |

0.88 |

1.01 |

SMB |

0.27 |

0.16 |

0.14 |

0.02 |

0.09 |

0.18 |

0.17 |

0.24 |

0.16 |

0.12 |

0.12 |

HML |

0.07 |

0.02 |

0.14 |

0.00 |

0.05 |

0.01 |

0.02 |

0.05 |

0.04 |

0.07 |

0.07 |

MOM |

0.08 |

-0.01 |

0.06 |

-0.02 |

-0.06 |

0.04 |

0.09 |

0.03 |

0.03 |

0.04 |

0.04 |

VOL |

0.12 |

0.15 |

0.02 |

0.12 |

0.13 |

0.07 |

0.06 |

-0.05 |

0.08 |

0.16 |

0.15 |

PRO |

0.09 |

0.03 |

0.12 |

0.07 |

0.08 |

0.06 |

0.05 |

0.04 |

0.07 |

0.16 |

0.16 |

INV |

0.02 |

-0.02 |

0.05 |

0.02 |

0.01 |

0.15 |

0.13 |

0.05 |

0.05 |

0.09 |

0.09 |

Factor Contribution |

0.75% |

1.22% |

-0.11% |

1.61% |

1.40% |

0.75% |

0.56% |

-1.14% |

0.63% |

2.04% |

2.06% |

Factor Intensity |

0.65 |

0.34 |

0.54 |

0.20 |

0.31 |

0.50 |

0.52 |

0.37 |

0.43 |

0.63 |

0.63 |

Factor Deconcentration |

3.84 |

2.24 |

4.65 |

2.00 |

2.59 |

3.96 |

4.35 |

1.96 |

3.20 |

5.14 |

5.11 |

Factor Exposure Quality |

2.48 |

0.77 |

2.50 |

0.40 |

0.81 |

1.98 |

2.24 |

0.72 |

1.49 |

3.24 |

3.22 |

The analysis is conducted from 31/12/2009 to 31/12/2019 on USD total returns. The Scientific Beta US cap-weighted index is used as the cap-weighted reference. The regressions are based on weekly total returns. The three-month US Treasury bill rate is used as the proxy for the risk-free rate. Factor exposures are based on a seven-factor model. The Market factor is the excess return series of the cap-weighted index of all stocks that constitute the index portfolio over the risk-free rate. The SMB factor is the return series of an equal-weighted portfolio that is long small-cap stocks and short for the top 30% stocks ranked by market capitalisation (large market-cap stocks). The HML factor is the return series of an equal-weighted portfolio that is long for the top 30% stocks (Value stocks) and short for the bottom 30% stocks (Growth stocks) sorted on book-to-market value in descending order. The MOM factor is the return series of an equal-weighted portfolio that is long the winner stocks and short the loser stocks. The winner stocks (inversely the loser stocks) are defined as the top 30% (inversely the bottom 30%) of stocks, sorted on the past 52 weeks' compounded returns excluding the most recent month, in descending order. The Low Vol factor is the return series of an equal-weighted portfolio that is long the bottom 30% stocks (Low Volatility stocks) and short the top 30% stocks (High Volatility stocks) sorted on past volatility in descending order. The High Profitability factor is the return series of an equal-weighted portfolio that is long the top 30% stocks (High Profitability stocks) and short the bottom 30% stocks (Low Profitability stocks) sorted on gross profitability in descending order. The Low Investment factor is the return series of an equal-weighted portfolio that is long the bottom 30% stocks (Low Investment stocks) and short the top 30% stocks (High Investment stocks) sorted on two-year asset growth in descending order. The factors are market beta neutralised ex-post on a quarterly basis. Factor intensity is the sum of non-market beta exposures. Factor deconcentration is the inverse of the sum of squared relative betas. Relative betas are each individual non-market factor beta divided by factor intensity. Factor Exposure Quality is the factor intensity multiplied by factor deconcentration. Factor Performance Contribution is the sum of factor contribution of each non-market factor over the period.

The risk factor exposure analysis in Exhibit 4 can reveal which factors the multi-factor indices were actually exposed to. Some competitive indices exhibit negative betas on factors which imply that they will be penalised from the long-term positive risk premium of the particular factor. Many show a low factor intensity (sum of non-market factor betas) which indicates poor factor exposures and as a result suffer from low factor contribution as depicted in the table. In addition, the factor deconcentration metric is a measure of factor diversification and for most competitor indices it is far from an optimal exposure of 6 which implies balanced allocation to all six rewarded risk factors.

Instead, Scientific Beta indices benefit from a dynamic multi-factor HFI filter4 that ensures that the factors' non-null cross-sectionality does not have an excessive impact either on the overall factor intensity or on the balance of the factor exposures. Given that the factor intensities are highly variable over time across the six factors, this filter's dynamic adjustment is important and over the medium term provides very good factor balance and an exposure quality that is much better than competitors'. We underline that our multi-factor indices deliver better factor intensity and factor deconcentration compared to the competitors' average. The factor intensity of our multi-factor index is 47% higher (0.43 against 0.63) over the last ten years than competitors that do not take account, for most of them, cross-factor interactions because they rely on scores and bottom-up construction approaches. Moreover, its factor deconcentration and factor exposure quality are 61% (3.20 against 5.14, similar for MBA) and 118% (1.49 against 3.24, similar for MBA) higher compared to the average competitors respectively over the last ten years. We underscore that, over the long-term, only strategies with well-balanced factor exposures and strong factor exposure quality can deliver strong factor contributions.