Climate Emergency and Investor Responsibility

Responding to the threat of Climate Change is the most pressing and important challenge of our era. The Earth has warmed by about 1 degree Celsius (1.8 degrees Fahrenheit) from pre-industrial times and the resulting changes in weather patterns, sea levels and frequency of extreme weather events are already affecting ecosystems, human communities and economies on a global scale.

Global warming is driven by the accumulation in the atmosphere of greenhouse gases. Over three quarters of this accumulation has occurred after the Second World War as greenhouse gas emissions dramatically accelerated, due to rapid growth in the consumption of fossil fuels for electricity, heat, and transportation.

On the current course, emissions are set to double and temperatures to rise from 3.7°C to 4.8°C (6.7°F to 8.6°F) by the end of the century. This would cause severe, extensive and in some cases irreversible damage to natural and human systems, contribute to substantial species extinction, create large risks to food security, exacerbate health issues, and compromise outdoor work and agriculture in some areas. Global warming on such a scale would also increase the risk of triggering natural feedback effects, such as the thawing of large areas of greenhouse-gas holding permafrost, which could limit humanity's potential for adaptation (IPCC, 2014).

The Paris Agreement on Climate Change, reached at the twenty-first Conference of the Parties held in late 2015, is a universal and legally binding agreement whereby 195 nations agree to work jointly to limit global temperature rise this century below 2 degrees Celsius and pursue efforts to target 1.5 degrees Celsius of warming. For the IPCC, the 2 degree scenario could be delivered if emissions fell by 40-70% relative to 2010 by 2050 and to zero or below in 2100 (IPCC, 2014). Such drastic reductions suppose radical changes in infrastructure and industrial processes, notably "decarbonisation" of the energy supply sector, which needs to see emissions decline from the next decade and fall by 90% or more between 2040 and 2070.1 These reductions are unlikely to take place without political leadership.

Unfortunately, signatories of the Paris Agreement have collectively submitted emissions reductions pledges that are short of the levels required to achieve the agreement's objective and the policies implemented by a majority of signatories have not been sized adequately to deliver these pledges; the stated intention of the United States to withdraw from the Agreement is also a major cause of concern.

Due to the timidity of the political response to date, businesses have mostly been able to continue to operate as usual.

However, it is conservative to assume that there will be growing ecological, socio-political, and economic pressure on governments to set and enforce climate policies to mitigate the consequences of Climate Change.

While political leadership has been sorely lacking in the past quarter century, 2019 could be a watershed year in the fight against climate change and its consequences. The Paris Agreement requires countries to submit new pledges in 2020 and ahead of this deadline, the United Nations Secretary General has invited leaders of government, business, finance, and civil society to convene in New York in September to commit to actions to address climate change. In particular, governments are expected to submit realistic plans to reduce emissions by 45% over the next decade and to zero by 2050. This meeting will convene at a time when public pressure has been mounting for governments to finally act in a decisive manner.

Following the example of Swedish teenage activist Greta Thunberg, millions of children have joined school climate strikes in over 125 countries this year to demand that governments implement a decarbonisation pathway aligned with the ambitions of the Paris Agreement. Youth strikes and civil disobedience actions in the United Kingdom have awakened public anger against the slow response to the challenge of global warming and have led the UK Parliament to declare a climate emergency on 1 May 2019 and then to sign into law upped decarbonisation targets at the end of June 2019. There is a renewed sense of urgency in tackling climate change and unprecedented momentum; with climate crisis disasters now happening at the rate of one a week, according to the United Nations Secretary General's special representative on disaster risk reduction,2 public pressure is unlikely to abate soon.

The eventual policy response is likely to include prohibitions or caps for activities with high absolute emissions and high intensity of emissions and the repricing of carbon for all as the result of massive fossil fuel subsidies being phased out and carbon trading schemes or taxes being aligned with decarbonisation objectives. For most companies, this policy response is a major component of the risks of a transition to a low-carbon economy which also include the impacts from changes in technologies, social norms and consumer behaviour and those "Transition Risks" are more of a concern in the short and medium term than the hazards from Climate Change and their consequences, i.e. the well-documented "Physical Risks" from Climate Change.

In this context, while ethical and socially responsible investors should be expected to orient their investments, engagement and outreach policies to contribute to the fight against Climate Change, it is the duty of all fiduciaries to consider the possible financial impacts of Climate Change on their portfolios.

Scientific Beta is committed to assisting institutional investors contribute to the transition to a low carbon economy and improve the resilience of their portfolios to climate change risks. Its experience in the matter dates back to the design of a dedicated Low Carbon index offering that it unveiled on the occasion of the Paris climate conference and has included helping large institutional investors incorporate ambitious climate change objectives into smart beta and factor investing investment mandates and designing a series of low carbon and fossil fuel reserves free indices to support the launch by Desjardins of a new suite of responsible investing ETFs. The July 2019 introduction of a Low Carbon Fiduciary Option is a new milestone as it allows for seamless incorporation of Climate Change considerations across Scientific Beta's entire flagship multi-smart factor index offering.

Scientific Beta's flagship High Factor Intensity Multi-Beta Multi-Strategy (HFI MBMS) 6 Factor indices solidly outperform the capitalisation-weighted indices of their parent universes over the long-term but have indirect contributions to greenhouse gas emissions ("carbon footprints") and exposure to carbon-intensive companies that compare negatively to those of these benchmarks, primarily as a result of factor tilting. Thus, decarbonisation of multi-smart-factor indices is both especially relevant and especially challenging.

The Low Carbon fiduciary option combines three approaches to decarbonisation:

- Negative screening ensures divestment from companies with significant coal involvement - the focus on Coal is mandated by it being the largest source of electricity and the conventional fuel with the lowest heating value normalised by greenhouse gas emissions.

- Positive screening targets the companies with the highest emissions per unit of revenues (Carbon Intensity) in key sectors exposed to Transition Risks and beyond. Screening is region neutral but given flexibility to strike a balance between exclusion efficiency and sector protection, while upholding best-in-class selection within each affected sector. As representation of the various industry groups is preserved, so are their presence in the derived indices and the ability to build sector-controlled indices.

- As acknowledgment that the best long-term investment strategies can be derailed by short-term performance considerations, the Low Carbon fiduciary option embarks a conditional adjustment mechanism that reduces the shortfall between the quarterly level of the Weighted Average Carbon Intensity (WACI) of the index and a desired long-term reference level, defined in relation to the level of the WACI of the parent-universe benchmark. WACI is targeted because it is the carbon metric that the Task-force on Climate-related Financial Disclosures recommends asset owners and managers report as a first step (TCFD, 2017).

The ESG incorporation philosophy of Scientific Beta centres on exclusions that are determined solely on ESG merits and demerits and applied as the first step of index construction. This approach respects the principles of ethical and socially responsible investors and, as a result, exclusions send clear signals to issuers and are straightforward to explain to stakeholders. From an ESG risk management point of view, the approach targets companies whose performance fails to meet uniform standards or lags that of their peers. Finally, from a traditional bottom line approach, the approach protects the scientifically validated sources of financial performance that smart beta and factor investing exploit.

The exclusionary screens of the Low Carbon fiduciary option incentivise the transition of shunned and other companies towards more sustainable activities and technologies and materially reduce the exposure of derived indices to assets that could be at a particularly high risk of stranding due to their coal involvement or that are likely to have high exposure to Transition Risks owing to their high Carbon Intensities. As such, derived indices demonstrate clear support to the transition to a low carbon economy and show higher resilience to Climate Change. These screens also promote reduced footprints in derived indices.

As the Low Carbon fiduciary option includes a Core ESG filter that also screens out companies that fall short of global standards of responsible business conduct and corporate governance or that are involved in activities that conflict with global ESG norms or their objectives, the pursuit of decarbonisation and financial performance is not allowed to inflict harm upon ESG norms.

The above expected benefits are confirmed in back-tests: Low Carbon versions of the High Factor Intensity Multi-Beta Multi-Strategy 6 Factor indices deliver drastic reduction of exposures to coal assets and the most carbon-intensive companies, material improvements in carbon footprints and a Weighted Average Carbon Intensity that, over the last ten years, is about half that of the benchmark on Developed Markets and even lower for Emerging Markets. These ESG benefits are delivered while retaining the financial outperformance of the standard flagship indices.

As such, the Low Carbon fiduciary option is relevant not only to ethical and socially responsible investors that wish to dissociate from companies that contravene global norms and promote the transition to a low carbon economy, but also to business-as-usual investors that recognise that Transition Risks may materially impact portfolio values and wish to mitigate these risks as a precaution.

References:

- Intergovernmental Panel on Climate Change (IPCC), 2014. Climate Change 2014: Synthesis Report. Contribution of Working Groups I, II and III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change [Core Writing Team, R.K. Pachauri and L.A. Meyer (eds.)]. IPCC, Geneva, Switzerland, 151 pp.

- Task Force on Climate-related Financial Disclosures (TCFD), 2017. Implementing the Recommendations of the Task Force on Climate-related Financial Disclosures, Financial Stability Board, available at https://www.fsb-tcfd.org/wp-content/uploads/2017/06/FINAL-TCFD-Annex-062817.pdf.

Footnotes:

1Carbon dioxide is the number one contributor to the greenhouse effect amongst the gases directly released by human activity and the key greenhouse gas to target for long-term global warming mitigation.

2One climate crisis disaster happening every week, UN warns, Guardian, 7 July 2019.

Scientific Beta Low Carbon Option – Supporting the Transition to a Low Carbon Economy and Protecting Multifactor Indices against Transition Risks

Over the last four years, Scientific Beta has accompanied investors in the transition to a Low Carbon economy with its off-the-shelf Low Carbon index offering and with indices designed to support custom mandates and responsible investing funds. To go further and put Climate Change considerations at the very core of its offering, Scientific Beta has now introduced a Low Carbon Fiduciary Option that can be applied across its entire flagship index offering, including where desired in combination with the Sector Neutral and Market Beta Adjustment Risk Control Fiduciary Options.

Scientific Beta's flagship High Factor Intensity Multi-Beta Multi-Strategy (HFI MBMS) 6 Factor indices solidly outperform the capitalisation-weighted indices of their parent universes over the long-term but have indirect carbon footprints and exposure to carbon-intensive companies that compare negatively to those of these benchmarks, primarily as a result of factor tilting. Thus, decarbonisation of multi-smart-factor indices is both especially relevant and especially challenging.

Low Carbon versions of the HFI MBMS 6 Factor indices deliver drastic reduction of exposures to coal assets and the most carbon-intensive companies, material improvements in carbon footprints and a Weighted Average Carbon Intensity that, over the last ten years, is about half that of the benchmark on Developed Markets and even lower for Emerging Markets. These ESG benefits are delivered while retaining the financial outperformance of the standard flagship indices.

The Low Carbon fiduciary option combines three approaches to decarbonisation:

- Negative screening ensures divestment from coal companies, companies with coal reserves, companies with significant revenues from thermal coal mining, and Utilities that rely significantly on coal for power generation – the focus on Coal is mandated by it being the largest source of electricity and the conventional fuel with the lowest heating value normalised by greenhouse gas emissions; phasing out coal is a priority in transition scenarios. Negative screening is also performed in respect of companies that fall short of global standards of responsible business conduct and corporate governance or that are involved in activities that conflict with global ESG norms or their objectives. The latter ensures that the pursuit of decarbonisation and financial performance will not be at the detriment of ESG norms.

- Positive screening targets the companies with the highest emissions per unit of revenues (Carbon Intensity) in key sectors exposed to Transition Risks and beyond. The exclusion budget is 10% of the regional universe by number of stocks. Screening is region neutral but given flexibility to strike a balance between exclusion efficiency and sector protection, while capping exclusions in each sector to 50% and upholding best-in-class selection within each affected sector. As representation of the various industry groups is preserved by this flexible best-in-class approach, so are their presence in the derived indices and the ability to build sector-controlled indices.

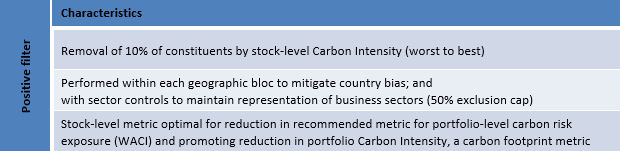

- As acknowledgment that the best long-term investment strategies can be derailed by short-term performance considerations, the option embarks a conditional adjustment mechanism that reduces the shortfall between the quarterly level of the Weighted Average Carbon Intensity (WACI) of the index and a desired long-term reference level, defined in relation to the level of the WACI of the parent-universe benchmark. Based on minute sector weight adjustments, it is triggered in the rate cases when the benchmark-relative reduction in index WACI falls below 35%. WACI is targeted because it is the carbon metric that the Taskforce on Climate-related Financial Disclosures recommends asset owners and managers report as a first step (TCFD, 2017).

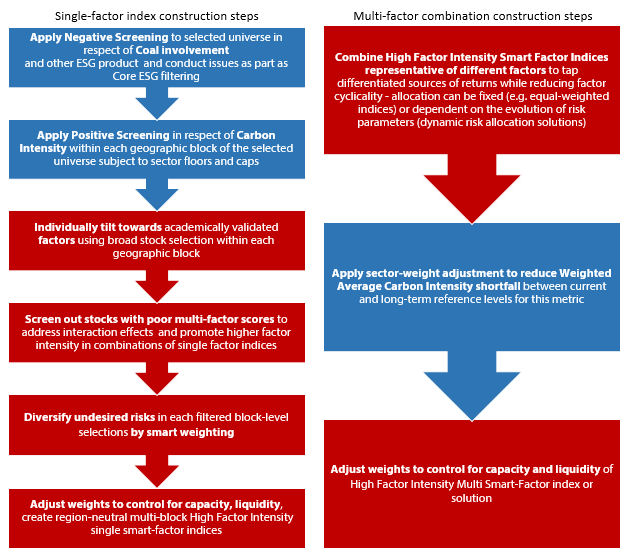

Figure 1 below illustrates how this triple decarbonisation approach is incorporated into flagship index construction.

Figure 1: Low Carbon High Factor Intensity Multi-Smart-Factor Index Construction Steps

ESG Incorporation Philosophy, ESG Exclusions and Decarbonisation Approaches

ESG Incorporation Philosophy

The ESG incorporation philosophy of Scientific Beta centres on exclusions that are determined solely on ESG merits and demerits and applied as the first step of index construction. This approach respects the principles of ethical and socially responsible investors and, as a result, exclusions send clear signals to issuers and are straightforward to explain to stakeholders. From an ESG risk management point of view, the approach targets companies whose performance fails to meet uniform standards or lags that of their peers. Finally, from a traditional bottom line approach, the approach protects the scientifically validated sources of financial performance that smart beta and factor investing exploit.

The respect of this philosophy allows the Low Carbon option to demonstrate unambiguous support for the transition to a low carbon economy, reduce exposure to Transition Risk and protect investment performance. Divestment from companies involved with particularly inefficient fuels or high Carbon Intensity contributes to increasing their cost of capital and incentivises transition by these companies and others. Reduced exposure to companies facing high levels of Stranding Risk or overall Transition Risk promotes the resilience of the index to Climate Change. In the absence of sound academic evidence documenting the existence of non-redundant ESG performance factors, dealing with ESG concerns or risks as a first step allows downstream index construction to concentrate on the assumption of rewarded systematic risks through factor-based security selection and the mitigation of conventional risks through the application of diversification weighting schemes to address unrewarded idiosyncratic risk and the imposition of risk controls on non-diversifiable risks through weight adjustments.

Negative Exclusion of Coal Companies and Other Core ESG Filter Exclusions

The coal involvement filter is part of the Core ESG filter that is embedded in all of Scientific Beta's off-the-shelf ESG Options. Anchored in international norms, this Core ESG filter is a collection of negative screens that span consensual product-based and conduct-based exclusions.

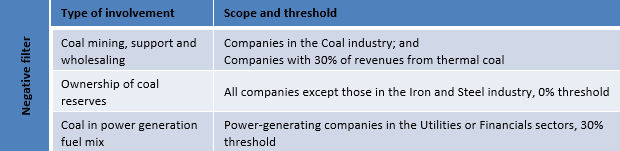

The bulk of the exclusions as per the Core ESG filter are in respect of coal companies as defined in Table 1 below.

Table 1: Coal-Involvement Filter of the Low Carbon Fiduciary Option

From an ethical and socially responsible investment standpoint, the focus on Coal is mandated by it being the largest source of electricity and the conventional fuel with the lowest heating value normalised by GHG emissions. In the 1.5 degree scenarios of the Intergovernmental Panel on Climate Change (IPCC), the median reduction in coal use between 2020 and 2050 is 85% and as far as energy generation is concerned, the median reduction in coal usage is 96% (IPCC, 2018).

Divestment of companies with a major role in the supply and demand for coal is not only consistent with a deontological approach, but by sending a clear signal to stakeholders and possibly increasing the cost of capital through reduced demand for securities (directly through divestment and indirectly by the promotion of increased uncertainty with respect to valuations), it also incentivises transition towards less environmentally harmful activities and technologies on the part of shunned and other companies.

From the point of view of potential financial materiality of ESG risks, the above figures suggest that coal-mining and coal usage, especially for energy production need to be drastically curtailed. If the transition is faster or more severe than the scenarios reflected in corporate accounts and earnings forecasts, the book value and/or the earning potential of coal assets will be impaired. If such impairments are not correctly anticipated by the average investor, coal companies will be repriced on the markets. Mitigating this risk of stranding can provide a financial motive for divestment.

While targeting coal in general, the exclusions focus on thermal coal as, in the medium-term, there is no economically-relevant at-scale substitute for metallurgical coal used for iron and steel manufacturing. The 30% threshold used in respect of thermal coal revenues and coal-fired power generation capacity is aligned with the current practices of leading asset owners and the expectations of major divestment campaigns.

Filtering out the stocks with significant coal involvement guarantees zero exposure to these stocks in all derived indices. It also promotes reductions in the emissions-based carbon metrics of derived indices as coal-fired power generation typically makes an outsized contribution to these metrics.

Positive Exclusion of High Carbon Intensity Companies

The second decarbonisation approach implements a region-neutral flexible best-in-class filter that excludes companies with high Carbon Intensity, i.e. greenhouse gas emissions to corporate revenues while protecting sector representation in each region. The emissions considered are direct corporate emissions, i.e. emissions from sources that are owned and/or controlled by the company, plus indirect emissions from the generation of electricity, steam, heating or cooling purchased/consumed by the company (Scope 1 and 2 emissions, respectively). Other indirect emissions that occur upstream (in relation to purchased goods and services) or downstream (distribution and use of the company's products and services) as reporting in respect of these (Scope 3 emissions) is seriously lacking and estimation models are insufficiently granular for stock-level decisions.

From a non-financial point of view, this approach to decarbonisation recognises that the transition to a low carbon economy goes beyond phasing out thermal coal and that carbon efficiency should be incentivised in key sectors and beyond. From the point of view of ESG risks with potential financial materiality, it acknowledges that Transition Risk pervades key transition sectors, e.g. Energy – Fossil Fuels, Utilities, Basic Materials (e.g. steel, cement), Transportation, Real Estate, and affects high carbon intensity companies across all sectors.

The filter ranks constituents in each region according to company level Carbon Intensity and exclusion proceeds strictly from worst (highest) to best (lowest) subject to sector rules, notably a 50% cap in the number of exclusions. Relative to a sector-neutral approach, the filter promotes materially higher impact for a given exclusion budget. This budget is set at 10% of the number of securities in each region.

Table 2: Carbon-Intensity Filter of the Low Carbon Fiduciary Option

The regional neutrality, sector protection and exclusion efficiency features of the Low Carbon filter allow to build indices that are aligned with their parents in terms of geographic exposure; preserve wide sector representation in standard indices and the ability to build sector-controlled indices; and protect the geographic and sector dimensions of rewarded factor exposures and the potential for idiosyncratic risk reduction by the application of diversification weighting schemes to a diverse pool of securities.

Filtering out the stocks with the highest Carbon Intensities, subject to sector controls, guarantees zero exposure to these stocks in all derived indices. It also promotes reductions in the emissions-based carbon metrics of derived indices, notably the portfolio-level Carbon Intensity – a carbon footprinting measure that normalises the sum of the indirect emissions owned by the investor by the sum of the corporate revenues owned (with ownership being in proportion to the share of the capital controlled by the portfolio) – and the portfolio-weighted average of constituent-level Carbon Intensities (WACI).

Weighted Average Carbon Intensity Shortfall Reduction

The Coal involvement and Carbon Intensity filters jointly remove the companies most exposed to Transition Risks from any derived index. This exclusionary approach typically promotes improved portfolio-wide average carbon metrics for derived multi-smart-factor indices relative to the levels produced by applying the same index construction methodologies to unfiltered universes. However, in keeping with the ESG incorporation philosophy of Scientific Beta, these portfolio averages are by-products of the screening and index construction methodologies rather than objectives or constraints determining individual security selection and weighting. It follows naturally that the levels of these metrics vary over time.

To protect long-term investment strategies tracking multi-smart-factor indices against questioning in respect of adverse short-term deviations of carbon metrics used by investors for reporting, the Low Carbon fiduciary option embeds a conditional shortfall reduction mechanism. The mechanism is activated when the WACI of the multi-smart-factor index to which the fiduciary option is applied fails to achieve a reduction of 35% relative to that of the benchmark. This trigger threshold was calibrated historically to ensure that adjustments would remain rare. In each region where there is a shortfall, the adjustment algorithm compares various ways of reallocating index weights from higher to lower WACI Economic Sectors to minimise the shortfall; as noted in Table 4 below, adjustments are highly constrained to preserve the financial characteristics of the index (and limit turnover).

Table 3: Weighted Average Carbon Intensity Shortfall Reduction of the Low Carbon Fiduciary Option

Historically, the United States is the region in which the mechanism is most often triggered for the Low Carbon version of the flagship HFI MBMS Six-Factor Index (Equal-Weighted). Figure 2 below illustrates the variability of the relative WACI decarbonisation over the ten years ended December 2018 and displays both the pre-adjustment WACI and the final index WACI to highlight the quarters in which the index required adjustment.

Figure 2: WACI of United States Low Carbon HFI Multi-Beta 6-Factor Index (Equal-Weighted), 2009-2018

Risks and Performances of Low Carbon Multi-Smart-Factor Indices

Decarbonisation Performance

Fossil Fuel Involvement and Carbon Asset Stranding Risk Metrics

In the assessment of stranding risk, we pay particular attention to the fossil fuel and power generation sectors.

Examining exposure to fossil fuel companies, we see that filtering leads to indices in which pure coal players are removed and exposure to companies with significant turnover from fossil fuels is reduced, including in the sector controlled version of the index.

Table 4: Fossil Fuel Sector Exposure for Various Indices, Developed Universe, 10-year Averages

To assess stranding risk in the fossil fuel sector, it is also relevant to look at reserved emissions, i.e. the greenhouse gas emissions associated with the fossil-fuel reserves of portfolio constituents. Table 5 below presents these reserves normalised in millions of tons of CO2 (per USD billion invested); because stranding is understood to materially differ on the basis of the fossil fuel, the top figure is disaggregated into coal on one hand and oil and gas on the other. Due to data limitations, we present the latest figures.

Table 5 below confirms that the Core ESG filter reduces normalised potential emissions from the burning of coal owned by universe constituents by over 90%. While exposure to Oil and Gas reserves is not controlled (and may increase as a result of reallocation across sectors in the absence of sector control or within sectors in its presence), the net impact, for Developed Markets, is a material reduction in overall reserved emissions.

Table 5: Potential Emissions Associated with Reserves, Various Indices, Developed Universe, December 2018

Table 6 below reports the weight, fuel mix and carbon efficiency of power-generating Utilities in the same indices at December 2018.

While the multifactor index construction methodology favours power-generating Utilities, the Low Carbon version of the index has materially lower exposure to these assets relative to the benchmark, including when sector control is imposed. More interestingly, filtering is found to materially reduce the weight of coal in the fuel mix of the power-generating Utilities in the index. While we observe an amount of substitution amongst "fossil fuels" (defined as coal plus oil and gas) towards cleaner fuels, the share of these fuels, also known as "brown share," is also reduced.

Table 6: Exposure to Power-Generating Utilities for Various Indices, Developed Universe, End of 2018

All in all, the Low Carbon option materially reduces the exposure to Transition Risk associated with power generation by reducing the importance of power-generation in the index and tilting the fuel mix of this group of constituents materially away from coal.

TCFD Carbon Metrics

Table 7 reports the normalised carbon footprinting and other exposure metrics that the TCFD considers of interest for reporting. Figures are averaged over 10 years.

The application of the Low Carbon option produces excellent decarbonisation as measured by carbon footprinting metrics (Carbon Intensity as introduced earlier as Carbon Footprint, which normalises owned emissions by current investment value) and Weighted Average Carbon Intensity. This suggests that the Low Carbon indices are associated with materially lower indirect contributions to Climate Change and materially reduced exposure to companies with potential high risk of exposure to Transition Risks. For illustration, the WACI of the Developed Low Carbon HFI MBMS 6 Factor (Equal-Weighted) index is less than 30% of that of its unfiltered counterpart and less than half that of the benchmark. Emissions-based metrics are also excellent for the sector-controlled version of the indices, which suggest that the reduction is not explained away by sector allocations. Notably, the WACI of the sector-neutral version of the Developed Low Carbon multifactor index is less than half (43%) that of its unfiltered counterpart and about half (49%) that of the benchmark. While the emissions-based decarbonisation of the universe is based on Scope 1+2 data only, we observe that decarbonisation in respect of Total Emissions, which also include Scope 3 emissions, is material.

Table 7 also shows that the exposure to Carbon Assets, i.e. companies in the Fossil Fuels sector and Fossil Fuel Electric Utilities, is reduced, including when the index is subjected to sector control (at the higher level of Ecomomic Sectors). More interestingly and as previously observed, index constituents from these sectors are materially less carbon intensive than the average of their peers, when the opposite is true for the standard indices.

Table 7: TCFD Carbon Metrics for Various Indices, Developed Universe, 10-year Averages

Financial Risks and Performance

Factor Exposures and Deconcentration as Sources of Performance

The two sources of long-term benchmark-relative outperformance that the Scientific Beta multi smart factor index methodology exploits are the exposure to rewarded risk factors beyond the broad equity market factor and improved diversification of idiosyncratic risk.

Table 8 presents the regression coefficients of derived indices for the CAPM and the seven factor model. The application of the coal-involvement filter reduces availability of (power generating) Utilities, a source of Low Volatility exposure in Developed Markets; this leads to a decrease in the exposure to the Low Volatility factor in the derived indices in the absence of sector control. Filtering also leads to higher exposure to High Profitability in derived indices irrespective of sector control, which is a typical observation with ESG filtering. Altogether, Developed Low Carbon multifactor indices have slightly higher factor intensity than their unfiltered counterparts. Interestingly, there is no evidence of abnormal performance once factors are recognised. In other words, the historical record does not support the idea that the decarbonisation and other ESG filters applied to the Developed universe add to or subtract from the performance of derived indices once loadings on consensual factors are accounted for.

Table 8: Factor Exposures in CAPM and 7 Factor Model for Various Indices, Developed Universe, 10 years

Table 9 presents the number of constituents and the effective number of constituents of derived indices. Numbers fall in line with the number of exclusions and all derived indices built from filtered universes remain significantly more deconcentrated than the benchmark, leaving good potential for diversification of idiosyncratic risk.

Table 9: Number of Constituents and Deconcentration of Various Indices, Developed Universe, December 2018

Risks and Performance Statistics

Table 10 below presents the performance and risk-adjusted performance of the standard and Low Carbon versions of the flagship indices over the last ten years.

In Developed Markets and in the absence of sector control, the Low Carbon versions of the indices have marginally better performance and risk-adjusted performance than their counterparts built from the unfiltered universe; no such difference is observed with sector control.

Table 10: Performance, Risk Adjusted Performance and Conditionality of Various Indices, Developed Universe, 10 years

Conclusion

The Low Carbon fiduciary option applicable across Scientific Beta's flagship offering allows ethical and socially responsible investors to dissociate from companies with significant coal involvement and further promote the transition to a low carbon economy by reorienting their investments towards less carbon-intensive activities and companies. From a socially responsible investment perspective, the benefits of this reallocation are demonstrated by the material reductions in the coal-asset exposure of derived indices and in the carbon footprints of these indices, notably as measured by financed emissions to financed revenues. Because it relies on an approach that determines potential inclusion into derived indices based solely on the coal involvement of each firm and its carbon intensity relative to peers, the Low Carbon fiduciary option sends clear signals to issuers regarding the urgency of decarbonising their operations and is straightforward to explain to beneficiaries, clients and other stakeholders; this compares positively to optimisation approaches that may consider an issuer's carbon profile as one of multiple criteria for selection and/or may engineer an attractive portfolio-wide carbon metric while allowing for the presence and possibly overweighting of firms with particularly poor carbon profiles.

By delivering a drastic reduction of exposure both to coal assets, which may become stranded in the transition to a low carbon economy and to the most carbon-intensive companies, the Low Carbon fiduciary option produces derived indices with higher resilience to Transition Risks relative not only to standard multifactor indices but also to parent universe benchmarks. Derived indices also boast benchmark-relative reductions in respect of Weighted Average Carbon Intensity, the carbon exposure metric recommended by the TCFD for reporting by asset managers and asset owners, of circa 50% over the last ten years. As such, they are also particularly relevant for investors that wish to implement multifactor investment strategies but recognise that Climate Change risks may materially impact portfolio values and wish to apply ambitious mitigation of these risks as a precaution.

Over the last ten years, the multifactor indices to which the Low Carbon fiduciary option has been applied are found to protect the sources of financial outperformance of the Scientific Beta multi smart-factor offering and typically perform in line with their unfiltered counterparts; supporting the transition to a low carbon economy and protecting against the risks of this transition had no meaningful impact on financial performance.

References:

- Intergovernmental Panel on Climate Change (IPCC), 2014. Climate Change 2014: Synthesis Report. Contribution of Working Groups I, II and III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change [Core Writing Team, R.K. Pachauri and L.A. Meyer (eds.)]. IPCC, Geneva, Switzerland, 151 pp.

- Intergovernmental Panel on Climate Change (IPCC), 2018. Summary for Policymakers. In: Global Warming of 1.5°C. An IPCC Special Report on the impacts of global warming of 1.5°C above pre-industrial levels and related global greenhouse gas emission pathways, in the context of strengthening the global response to the threat of climate change, sustainable development, and efforts to eradicate poverty [V. Masson-Delmotte, P. Zhai, H.-O. Pörtner, D. Roberts, J. Skea, P.R. Shukla, A. Pirani, W. Moufouma-Okia, C. Péan, R. Pidcock, S. Connors, J.B.R. Matthews, Y. Chen, X. Zhou, M.I. Gomis, E. Lonnoy, Maycock, M. Tignor, and T. Waterfield (eds.)]. World Meteorological Organization, Geneva, Switzerland, 32 pp, available at https://www.ipcc.ch/sr15/.

- Task Force on Climate-related Financial Disclosures (TCFD), 2017. Implementing the Recommendations of the Task Force on Climate-related Financial Disclosures, Financial Stability Board, available at https://www.fsb-tcfd.org/wp-content/uploads/2017/06/FINAL-TCFD-Annex-062817.pdf.

![]()

Scientific Beta Low Carbon Option – Supporting the Transition to a Low Carbon Economy and Protecting Multifactor Indices against Transition Risks, Scientific Beta white paper, June 2019

Scientific Beta Enhanced ESG Reporting – Supporting Incorporation of ESG Norms and Climate Change Issues in Investment Management

The incorporation of Environmental, Social and Governance (ESG) dimensions into investment analysis and decision-making processes and reporting has traditionally been optional and a low priority for most institutional investors. However, this is changing rapidly owing to both push and pull factors. On the one hand, institutional investors are increasingly required, or expected, to explain how they factor ESG dimensions into investment decisions and to report on their ESG incorporation processes and the ESG performance of their investments. On the other hand, a growing number of institutional investors consider that the ESG characteristics of investments may have a material impact on investment risks and returns or recognise that an increasing share of end-investors wish to see the environmental and social impacts of investments being considered together with their financial characteristics.

As business-case investors incorporating ESG dimensions to enhance returns and/or strengthen risk management join traditional values-based investors imposing non-financial constraints and/or objectives to align their investments with personal values or social norms, the motivations for incorporating ESG data into investment management have never been so diverse.

Scientific Beta recognises the diversity of these motivations and its ESG and Low Carbon Fiduciary Options, as well as the Enhanced ESG Reporting, are designed to serve the needs of ethical and socially responsible investors as well as those of business-case ESG investors.

Since inception, Scientific Beta has been offering unparalleled transparency on the financial risks and performances of its indices along with fiduciary options allowing investors to control non-diversifiable risks. The Enhanced ESG Reporting, along with the ESG and Low Carbon Fiduciary Options also introduced in July 2019, extend this tradition into the ESG space.

Specifically, the objective of Scientific Beta's Enhanced ESG reporting is to assist investors with the incorporation of ESG dimensions into their investment analysis and decision-making processes as well as their mandatory and voluntary disclosures.

The Scientific Beta Enhanced ESG Reporting includes over a dozen reports covering ESG Norms and Climate Change and is offered on a complimentary basis and available not only for ESG and Low Carbon Option indices but across the entire index offering. It is relevant to investors whose ESG objectives or constraints may include one or several of the following:

- Discharging of ESG reporting obligations;

- Dissociating from companies involved in controversial products and conducts;

- Incentivising the respect of global norms and/or the transition to a low-carbon economy;

- Improving investment resilience to climate change;

- Shunning investments that could create reputational and liability risks;

- Altering the expected risk/return profile of the portfolio by avoiding companies whose ESG performances may expose the portfolio to material adverse financial impacts.

ESG Norms Reporting

Scientific Beta's ESG Norms analytics measure index exposure to companies with involvement in products that conflict with global ESG norms or their objectives and to companies whose conduct violates fundamental ethical or corporate governance norms.

Such assessments have relevance for ethical and socially responsible investors as well as for business-as-usual investors as shown in Table 1.

Table 1: Possible Motivations for Analysing Respect of Global Norms

Responsible Business Conduct and Corporate Governance Norms and Analytics

Responsible Business Conduct: Ethical Norms Report

There are two international initiatives that define principles of responsible business conduct by drawing on international conventions and declarations with (quasi) universal consensus:

- Launched in 2000, the United Nations Global Compact ("Global Compact") is the world's most successful voluntary corporate responsibility initiative;

- Originally issued in 1976 and regularly updated, the OECD Guidelines for Multinational Enterprises are government recommendations to multinationals operating in or from adhering countries (48 such countries as at July 2019).

Scientific Beta relies on the UN Global Compact as the main reference because of its scope and simplicity. The UN Global Compact Ten Principles are derived from the Universal Declaration of Human Rights, the International Labour Organisation's Declaration on Fundamental Principles and Rights at Work, (1998, review 2010), the Rio Declaration on Environment and Development (1992) and the United Nations Convention Against Corruption (2005).

The Ethical Norms Report tracks (i) exposure to companies that present high risk of future gross violations of fundamental ethical norms and (ii) exposure to companies that are facing critical ESG controversies in respect of their fundamental responsibilities.

Table 2: Ethical Norms Report for Sample Flagship Index at End June 2018

To measure the risk of gross violations of fundamental norms, we rely on the public and substantiated exclusion list prepared by the Central Bank of Norway ("Bank") for the management of the country's Government Pension Fund Global. The Bank's framework reasonably maps the Ten Principles of the Global Compact. When deciding upon exclusions, the Bank is required to consider the exercise of ownership rights or other measures that may be more suited to reduce the risk of continued norm violations and authorised to consider the probability of future norm violations. The latter may be informed by the quality of the company's risk management architecture and by how the company is responding to ESG controversies and notably whether it is putting forward remediating or corrective measures as well as preventative measures. Being concerned with grossly unethical conduct, framed in a consequentialist approach, and made to integrate forward-looking and risk-management considerations, the Bank's exclusions are necessarily limited. Their objective is not to implement a reaction to past corporate transgressions but to serve as a defence mechanism for the investor against the risk of complicity in unacceptable practices going forward.

By contrast, our tracking of companies facing critical ESG controversies in respect of their fundamental responsibilities is based solely on past transgressions and disregards the response of the company and the frequency of controversies. A critical controversy relates to a fundamental issue and has high adverse impact on a large scope and fundamental issues are in relation to the four areas covered by the Global Compact as above, i.e. human rights, labour, environment and anti-corruption. Controversy screening and criticality assessment are performed by Vigeo-Eiris. Added to this list are companies ineligible to join the Global Compact, which notably include those that are subject to a United Nations (UN) sanction or listed on the UN Ineligible Vendors List for ethical reasons.

Corporate Governance Norms: Non-voting Shares Report

Proportionality between corporate ownership and control protects all shareholders against conflicts of interest and is expected to promote good corporate performance and market efficiency via internal and external (i.e. the market for corporate ownership and control) mechanisms.

The issuance of multiple share classes and the reliance on cascading shareholdings are the main, age-old, mechanisms to leverage the power of certain shareholders to the detriment of others.

There has been considerable interest in multiple-class share structures recently due to their resurgence and growing usage, notably by technology companies, starting with Google in 2004, and in the wake of excesses such as the 2017 decision by Snap Inc. to only list non-voting shares. In this context, concerned U.S. investor groups have lobbied stock exchanges to impose restrictions on multiple class structures and index providers to look into excluding non-voting shares.

The G20/OECD Principles of Corporate Governance, which are the leading corporate governance benchmark endorsed by governments, recognise voting rights as one of the basic shareholder rights but do not require proportionality.

Against this backdrop, the Non-Voting Shares Report measures the cumulated weight of index constituents issued by companies that only offer non-voting stocks to the public.

Table 3: Non-Voting Shares Report for Sample Flagship Index at End June 2018

Norms and Analytics Covering Controversial Products and Activities

Global norms in respect of prohibited and restricted activities centre on weapons that violate fundamental humanitarian principles through their normal use due to their disproportionate or indiscriminate impact (hereafter "Controversial Weapons"). Activity or product-based exclusions in relation to global norms may go beyond the strict respect of the letter of a treaty and target companies whose activities or products are fundamentally at odds with the ESG objectives pursued by the treaty. In this regard, we focus on two areas of strong institutional investor interest – tobacco and climate change – for which global norms with close to universal support exist.

Legally binding in 181 countries (out of 195), the 2003 World Health Organization (WHO) Framework Convention on Tobacco Control aims "to protect present and future generations from the devastating health, social, environmental and economic consequences of tobacco consumption and exposure to tobacco smoke by providing a framework for tobacco control measures (…) in order to reduce continually and substantially the prevalence of tobacco use and exposure to tobacco smoke."

Ratified by all the member states of the United Nations, the 1992 United Nations Framework Convention on Climate Change aims for the "stabilisation of greenhouse gas concentrations in the atmosphere at a level that would prevent dangerous anthropogenic interference with the climate system". Ratified by 185 Parties to the Convention (out of 197), the 2015 Paris Agreement has as its first aim to hold the increase in the average global temperature well below two degrees Celsius above pre-industrial levels and pursuing efforts to target an increase of 1.5 degrees Celsius.

Institutional investment in respect of tobacco and climate change is demonstrated by fund flows: tobacco screening has recorded the fastest growth amongst exclusions in recent years and is now the most popular screen globally (GSIA, 2019; Eurosif, 2018) while fossil fuel divestment registers high interest globally and climate change is the second ESG theme in the US responsible investment industry by assets to which it is applied (US SIF, 2018).

Controversial Weapons Report

The Controversial Weapons Report measures the cumulated weight of index constituents whose issuers are involved in controversial weapons in general and in two groups of such weapons in particular:

- Anti-Personnel Landmines and Cluster Munitions have been the subject of successful international campaigns, which have made them widely reviled amongst the public and have led to several countries prohibiting financial institutions from investing directly or indirectly in companies involved in these weapons and to investors voluntarily adopting these investment prohibitions. Note that involvement in these weapons disqualifies a company for recognition as a participant in the UN Global Compact.

- Weapons of Mass Destruction, i.e. Nuclear, Bacteriological and Chemical (NBC) weapons are those most often excluded voluntarily by investors after Anti-Personnel Landmines and Cluster Munitions; while some investors limit the exclusion in respect of Nuclear weapons to those companies in breach of the Non-Proliferation Treaty, a growing numbers of investors extend the prohibition to all companies with involvement in Nuclear weapons.

Table 4: Controversial Weapons Report for Sample Flagship Index at End June 2018

Public sources and Vigeo-Eiris data are used to produce this report.

Tobacco Report

This report tracks exposure to Tobacco Industry companies and companies with involvement in the production of tobacco regardless of the percentage of revenues represented by this activity and exposure to companies that derive more than 5% of their revenues from the production or distribution of tobacco. Public sources are relied upon for the former assessment and Vigeo-Eiris data are used for the latter.

Table 5: Tobacco Report for Sample Flagship index at End June 2018

Involvement in the production of tobacco products concerns only complete tobacco products, which corresponds to the definition of involvement adopted by the Tobacco-Free Finance Pledge (2018) and is consistent with the definition disqualifying a company for recognition as a participant in the UN Global Compact (2017).

Coal Report

This report tracks exposure to companies with significant involvement in coal as per industry classification, turnover, and ownership of reserves or, in the case of Utilities, usage for power generation.

The rapid phasing out of coal is key to averting the climate catastrophe. McGlade and Ekins (2015) estimate that 82% of coal reserves need to remain unburned before 2050 in the 2-degree scenario. In this context, coal-powered plants and the entire coal supply chain face high exposure to stranding risk.

Table 6: Coal Report for Sample Flagship Index at June 2018

In the medium-term, there is no economically-relevant at-scale substitute for metallurgical coal used for iron and steel manufacturing, hence we focus on thermal coal and disregard companies with Iron & Steel industry classification for the coal reserves analytics.

Climate Change Reporting

Climate Change reports look into the greenhouse gas emissions associated with the operations of index constituents and provide indicators of relevance to the assessment of potential impacts of climate change on the values of portfolio holdings. Impact may be from physical effects – of an acute nature (e.g. damage to assets or supply chain disruptions due to climate events) or a chronic nature (e.g. changes to resource availability or productivity, increase in temperatures or sea level); from regulatory, technology and market changes brought about by the need to mitigate the effects of climate change and transition to a low greenhouse gas economy or from climate change-related litigation (e.g. in relation to a company's failure to mitigate climate change or adapt to it, of insufficient climate change disclosure). Impacts may be through revenues, expenditures, assets and liabilities, and access to funding.

It is typical to classify Climate Change Risks into Physical Risks and Transition Risks, with the latter including Litigation Risks. Stranding Risk, the risk of early or unexpected asset impairment or conversion to liability as a result of climate change is usually considered only in the context of the risks of the transition to a low carbon economy.

Scientific Beta Climate Change reporting is meant to support analysis and reporting in regards to contribution to Climate Change; overall exposure to Transition Risks and Stranding Risks; and exposure to Physical Risks.

Measuring Contribution to Climate Change

Carbon Footprinting Report

Carbon Footprinting entails allocating to the portfolio a share of the greenhouse gas emissions of each holding in proportion to the share of its capital that is controlled by the portfolio. As such, it measures the indirect responsibility of a portfolio's investor in respect of emissions.

Corporate emissions are assessed in respect of three scopes as shown in Table 7. Because, self-reported Scope 3 data is sparse and lacking in quality, assessment of Scope 3 emissions relies on modelling and company to company comparisons are typically based on metrics computed from Scope 1 and 2 data. All emissions data are sourced from Institutional Shareholder Services.

Table 7: Scopes of Greenhouse Gas (GHG) Emissions

The three most common carbon footprinting metrics are: Total Emissions, Carbon Footprint and Carbon Intensity. Total Emissions represents the absolute footprint of the portfolio, whereas Carbon Footprint normalises Total Emissions by the current market value of the portfolio and Carbon Intensity by the revenues controlled by the portfolio.

Table 8: Carbon Footprinting Report for Sample Flagship Index at December 2018

Total Emissions are provided for the capitalisation-weighted index of the parent universe under the assumption of ownership of the entire free-float of each index constituent, an assumption that is broadly consistent with the weighting scheme of the index. No such assumption can be made for alternative-weighted indices to determine a level of investment and the corresponding figure for Total Emissions.

Assessing Exposure to Transition Risks

Carbon Exposure Report

This report measures portfolio exposure to carbon-intensive companies and sectors though two metrics:

- Weighted Average Carbon Intensity (WACI), which is the portfolio-weighted average of constituent-level Carbon Intensities and the carbon metric that the Taskforce on Climate-related Financial Disclosures recommends for portfolio reporting (TCFD, 2017).

- Exposure to Carbon-related Assets, which is the combined exposure to the fossil fuel sector and fossil-fuelled fired Utilities sector.

While a measure of exposure to carbon-intensive companies, WACI is often used as a proxy for exposure to carbon-price risk. Because Exposure to Carbon-related Assets relates to assets that are particularly at risk in the transition to a low carbon economy, it is typically used for broad-brush estimation of stranding risk in the portfolio. To promote a finer-grain understanding of exposure, Scientific Beta breakdowns exposure into sub-sectors and reports WACI for each category.

Table 9: Carbon Exposure Report for Sample Flagship Index at End June 2018

WACI Decomposition Report

WACI Decomposition is a single-period, holding-based method which, in the spirit of Brinson, Hood and Beebower (1986), breaks down the WACI of the index relative to that of its cap-weighted reference into sector-weighting, intra-sector stock-selection and interaction effects. This decomposition sheds light on the quality of a portfolio's decarbonisation.

Table 10: WACI Decomposition for Sample Flagship Index at End June 2018

In the example of Table 10, the reduction in WACI relative to the benchmark results from a positive stock-selection effect (112%), a negative sector effect (-27%) and a positive interaction effect (15%); this illustrates that the decarbonisation is not achieved by the underweighting of carbon intensive sectors but despite overweighting these.

Deep-Dive into Carbon-Related Assets: Reserved Emissions, Fossil Fuels and Power Generation Reports

Deep-dive reporting into carbon-related assets allows for finer-grain assessment of investment exposure to assets and sectors with high stranding risk potential due to their involvement in fossil fuels, on the supply or demand sides.

Reserved Emissions Report

This report shows the potential carbon dioxide emissions associated with the burning of fossil-fuel reserves controlled by an investment portfolio. In the absence of corporate disclosures of reserved emissions, these are estimated from reserves figures that are reported by, or attributed to, companies. These emissions are normalised by investment value and disaggregated into emissions from Coal reserves vs. emissions from Oil and Gas reserves (including Natural Gas Liquids and Bitumen) because the stranding risk of the former is materially higher than that of the latter. Reserved emissions data are sourced from Institutional Shareholder Services.

Table 11: Reserved Emissions Report for Sample Flagship Index at End June 2018

Fossil Fuels Report

This report measures investment exposure to the fossil fuels industry and companies with significant fossil fuel involvement, in aggregate and for specific fuels. Exposure is measured according to industry classification and turnover from fossil fuels. Data for computation of the latter are sourced from Institutional Shareholder Services. To promote a finer-grain understanding of exposure, Scientific Beta breakdowns exposure into sub-sectors and reports WACI for each category.

Table 12: Fossil Fuels Report for Sample Flagship Index at End June 2018

Power Generation Report

Scientific Beta reports the cumulated percentage weight of index constituents from the Utilities and Financials sectors that generate power along with the power-generation capacity that they command and their capacity-weighted fuel mix. The Weighted Average Carbon Intensity of this group of assets is also reported to support finer grain analyses.

Table 13: Power Generation Report for Sample Flagship Index at End June 2018

Scientific Beta reports the cumulated percentage weight of index constituents from the Utilities and Financials sectors that generate power along with the power-generation capacity that they command (for a USD1bn investment in the index) and their capacity-weighted fuel mix.

Assessing Exposure to Physical Risks

Physical Risks Report

This report presents the estimated exposure of index constituents to the long-term and acute physical risks from climate change. The assessment of physical risk exposure at index-constituent level is based on a sector and geographic approach. Based on its main field of activity, a company is allocated to a sector in the proprietary classification system of the data provider and attributed the corresponding risk level. This assessment is sourced from Institutional Shareholder Services.

Table 14: Carbon Exposure Report for Sample Flagship Index at End June 2018

Conclusion

Scientific Beta's Enhanced ESG Reporting, which is offered on a complimentary basis across the index offering, demonstrates Scientific Beta's commitment to transparency on the risks of its index strategies and to assisting investors in meeting the challenges and seizing the opportunities of ESG incorporation in investment management.

The ESG Norms analytics measure index exposure to companies that are found to fall short of global standards of responsible business conduct and corporate governance or to have involvement in activities that conflict with global norms or their objectives.

The Climate Change Analytics support assessments of the indirect contribution of index-tracking portfolios to Climate Change, assessment of index exposure to companies and sectors with high potential to Transition Risks, and assessment of index constituent exposure to Physical Risks.

Scientific Beta's researchers have accompanied investors with the incorporation of ESG objectives and constraints in passive investment for ten years and a third of the assets tracking Scientific Beta indices track indices that incorporate ESG dimensions.

Scientific Beta's Enhanced ESG Reporting is thus available for the whole range of Scientific Beta indices, including those without fees based on ESG or Low Carbon options. This approach, based on transparency and free access to information pertaining to ESG and climate risk, is our contribution to a collective effort to build a better world. ESG and climate risk mitigation must not only represent good business for solution providers but also for the planet!

References:

- Brinson, G. P., L. R. Hood and G. L. Beebower, 1986. Determinants of Portfolio Performance. Financial Analysts Journal, Volume 42, Issue 4, pp. 39-44.

- Eurosif, 2018. EUROPEAN SRI STUDY 2018. EUROSIF A.I.S.B.L. European Sustainable Investment Forum, Brussels, available at: http://www.eurosif.org/wp-content/uploads/2018/11/European-SRI-2018-Study-LR.pdf.

- GSIA, 2019. Global Sustainable Investment Review 2018, available at: http://www.gsi-alliance.org/wp-content/uploads/2019/03/GSIR_Review2018.3.28.pdf.

- McGlade, C. and P. Ekins, 2015. The geographical distribution of fossil fuels unused when limiting global warming to 2 °C. Nature, Volume 517, pp. 187–190.

- US SIF, 2018. Report on US Sustainable, Responsible and Impact Investing Trends – 2018 Trends Report Highlights, US SIF, available at: https://www.ussif.org/files/2018%20_Trends_OnePager_Overview(2).pdf.

- Task Force on Climate-related Financial Disclosures (TCFD), 2017. Implementing the Recommendations of the Task Force on Climate-related Financial Disclosures, Financial Stability Board, available at https://www.fsb-tcfd.org/wp-content/uploads/2017/06/FINAL-TCFD-Annex-062817.pdf.

![]()

Scientific Beta Enhanced ESG Reporting – Supporting Incorporation of ESG Norms and Climate Change Issues in Investment Management, Scientific Beta white paper, July 2019

The Risks of Deviating from Academically-Validated Factors

A webinar hosted by Felix Goltz, Research Director at Scientific Beta, on 13 June, 2019 discussed factor definitions used in investment products and analytic tools offered to investors and contrasted them with the standard academic factors. It also outlined why the methodologies used in practice pose a high risk of ending up with irrelevant factors.

Factor investing has never been as popular as it is today. However, with the propagation of this type of investment approach, the equity space is becoming increasingly saturated with more and more factors that are ever more removed from academically-grounded research. In a bid to maintain their apparent competitive advantage and to show that they are still delivering alpha, commercial index providers and asset managers have respectively embarked on a factor finding process that has resulted in the discovery of tens, hundreds or even thousands of factors. However, proprietary factor definitions and analytic toolkits based on non-standard factor indices can lead to unintended exposures and misunderstandings surrounding the associated risk exposures. The further away they are from academically-validated research, the more spurious and redundant proprietary factor definitions may be.

![]()

The Risks of Deviating from Academically-Validated Factors, Scientific Beta white paper, February 2019

Interview with Frédéric Ducoulombier, ESG Director, Scientific Beta

In this interview, Frederic Ducoulombier, ESG Director at Scientific Beta, discusses the launch of the Enhanced ESG Reporting and ESG and Low Carbon Fiduciary Options and how Scientific Beta's ESG incorporation philosophy fits in the evolving ESG investment space.

Why is Scientific Beta launching Enhanced ESG Reporting on its indices and introducing ESG Fiduciary Options?

The incorporation of Environmental, Social and Governance (ESG) dimensions into investment analysis and decision-making processes and reporting has traditionally been optional and a low priority for most institutional investors. However, this is changing rapidly owing to both push and pull factors. On the one hand, institutional investors are increasingly required, or expected, to explain how they factor ESG dimensions into investment decisions and to report on their ESG incorporation processes and the ESG performance of their investments. On the other hand, a growing number of institutional investors consider that the ESG characteristics of investments may have a material impact on investment risks and returns or recognise that an increasing share of end-investors wish to see the environmental and social impacts of investments being considered together with (or ahead of) their financial characteristics.

Since inception, Scientific Beta has been offering full transparency on the financial risks and performances of its indices along with fiduciary options allowing investors to control non-diversifiable risks. The Enhanced ESG Reporting, along with the ESG and Low Carbon Fiduciary Options, extend this tradition into the ESG space.

The Enhanced ESG Reporting is meant to support decision making and reporting in respect of indices. It includes over a dozen reports covering ESG Norms and Climate Change and is offered on a complimentary basis across the entire index offering. ESG Norms Reporting gives investors transparency on index exposure to companies that fail global norms of responsible business conduct and governance or that are involved in activities that conflict with global norms or their objectives in key areas of interest to investors. Climate Change reporting includes assessments of the indirect contribution of index-linked investments to climate change, of exposure to companies, sectors and assets that are particularly at risk of adverse disruption in the transition to a low carbon economy and of exposure to companies that are facing different degrees of disruption due to the physical risks of climate change.

While Scientific Beta researchers have been helping investors with the incorporation of ESG dimensions into passive investments for ten years in the context of custom mandates and dedicated indices, the ESG and Low Carbon Fiduciary Options are meant to facilitate this integration into our flagship offering. Indeed, these options are applicable across the entire High Factor Intensity multi-smart factor offering and can be combined with the Sector Neutral and Market Beta Adjustment options. The Low Carbon Fiduciary Option reduces allocation to coal assets and carbon-intensive companies across sectors to support the transition to a low carbon economy, reduce contribution to climate change and improve resilience to the risks of the transition. The ESG Fiduciary Option focuses on the removal of companies that fail high standards of responsible business conduct and corporate governance or engage in activities that conflict with global ESG norms or their objectives. As such it promotes adherence to high ESG standards, reduces investor reputational risk and reduces exposure to companies whose ESG performances may have a detrimental financial impact on the portfolio.

How does Scientific Beta view the evolution of practices in terms of ESG incorporation and the future of responsible investing?

ESG incorporation started with faith-based exclusions of sin stocks and diversified in the second half of the twentieth century with the advent of Socially Responsible Investing, an approach that relies on both financial and ESG characteristics to build portfolios with progressive ESG agendas. In an effort to develop demand for Socially Responsible Investing, some of its advocates introduced the promise of outperformance to try and address the concerns of fiduciaries that lacked a clear mandate to adopt ESG progressive strategies if this involved non-competitive risk-adjusted returns and lure business-as-usual investors. This had limited success, leading promoters of the mainstreaming of ESG incorporation to promote business-case or materiality ESG. Proponents of that approach correctly represent that ignoring ESG data with financial materiality is a breach of fiduciary duty. With this approach however, the investor loses agency on ESG matters and the ESG performance of an investment is an uncontrolled by-product of conventional risk and investment management decisions – there is no guarantee that the portfolio will meet ESG norms or produce ESG progress; we are back to business as usual, but with an extended dataset.

This is consistent with Milton Friedman's view of business responsibility – the mission of the corporation is to maximise shareholder value within the confines of the law. In this model, it is incumbent on lawmakers to define standards and on the administration and courts to enforce them. This position has the great merit of clarity and underlines that ESG progress will be determined by stakeholders demanding it in their engagements with corporates or imposing it via political action.

Investment is one of multiple channels of engagement and while materiality ESG is presented as The End of History for ESG incorporation, there is clear evidence that a growing number of investors hold views that are consistent with the pursuit of truly progressive ESG agendas, in the spirit of Socially Responsible Investing. This is observed even in countries that lag in their adoption of ESG incorporation. By way of illustration, a 2017 survey of U.S. individual investors by the Morgan Stanley Institute for Sustainable Investing found 23% of the population and 38% of millennials to be very interested in sustainable investing (up 4 and 10 percentage points over 2015, respectively) and a majority of respondents and 63% of millennials to be expecting a financial trade-off from investing sustainably (Morgan Stanley, 2017). Analysis of fund flows suggests that investors act on sustainability preferences – Hartzmark and Sussman (2019) find that market-wide demand for U.S. mutual funds varies as a function of their sustainability ratings in manner that is "consistent with positive affect influencing expectations of sustainable fund performance and non-pecuniary motives influencing investment decisions."

As business-case investors incorporating ESG dimensions with a view to strengthening risk management or enhancing returns join traditional values-based and socially responsible investors that wish to align their investments with personal values or social norms and to seek positive ESG impact, the motivations for incorporating ESG data into investment management have never been so diverse.

We thus think that the future of ESG incorporation is bright although we remain concerned by the risks of misleading denominations. It is telling that Responsible Investing – as defined by PRI, the largest ESG-focused organisation in the investment management industry – does not require a progressive ESG agenda or even a positive ESG impact. While PRI has demonstrated commitment to ESG progress, the amoral incorporation of ESG information into standard investment decision making is sufficient to claim the responsible investing badge. Potentially hosting ESG regressive investment strategies under the banner of responsible investing is fraught with reputational risk for the entire industry and in this regard, it is interesting to remark that "mistrust and concerns about greenwashing" is cited ahead of lack of advice, performance concerns or risk management issues as the main hindrance to the adoption of responsible investing (Eurosif, 2018). Assuming this could be corrected –– investors with progressive agendas would still need a label they could trust to identify products that go beyond compliance with laws and usage of ESG data for financial profile optimisation. The work of European lawmakers in respect of a taxonomy for environmentally sustainable economic activities is an interesting development.

How does Scientific Beta position itself in respect of ESG incorporation?

Over the last ten years, our researchers have assisted a wide variety of investors with the incorporation of ESG dimensions into their passive investments. Given our academic origins, this has been done in a manner that respects our investment tenets and the extant academic evidence on the financial relevance of integrating non-financial information into portfolio construction.

The ESG incorporation philosophy of Scientific Beta centres on exclusions that are determined solely on ESG merits and demerits and applied as the first step of index construction. This approach respects the principles of ethical and socially responsible investors and, as a result, exclusions send clear signals to issuers and are straightforward to explain to stakeholders. From an ESG risk management point of view, the approach targets companies whose performance fails to meet uniform standards or lags that of their peers. Finally, from a traditional bottom line approach, the approach protects the scientifically validated sources of financial performance that smart beta and factor investing exploit. As for factor tilting, despite several decades of research into ESG investment strategies, the extant theoretical and empirical evidence cannot justify the addition of progressive ESG factors to our strategic factor menu or the augmentation of well-established factors by ESG signals. Likewise for scientific diversification weighting, the literature on improving risk parameter estimation with ESG data, while more promising, is still very much in its infancy.

This is in stark contrast with integrated ESG approaches that allow for compensation between ESG and financial characteristics at the security level and/or approach ESG performance as a portfolio average and allow a higher allocation to ESG leaders to make up for a higher allocation to ESG laggards. Exclusions based on composites of ESG and financial performance convey mixed signals to issuers in respect of the importance of integrating ESG considerations and may be challenging to explain to stakeholders. Approaches driven by average ESG scores at the portfolio-level assume that the utility of ESG performance is linear when casual observation and academic studies indicate that poor ESG performance matters more to consumers than strong ESG performance. For the average investor with progressive ESG motivations, it is unlikely that the non-financial impact of holding a company facing a critical controversy could be neutralised by an investment of the same amount in a company that has earned a corporate sustainability award; and for investors following a deontological approach, the suggestion is obscene. Even for a business-as-usual investor, the mere assumption of controversy risk aversion invalidates the possibility of a linear relationship between ESG performance and its utility. Approaches driven by portfolio-level averages also assume that the risks that ESG scores may proxy are linear; while this may be convenient, this is not a conservative approach to take for downside risk management in the absence of theoretical or empirical justifications. In traditional financial terms, approaches based on composites of ESG metrics and traditional financial signals lack theoretical support and may dilute control over the assumption of rewarded risk factors and hamper diversification or control of unrewarded or unwanted risks.

It is important to underline that while we do not represent that ESG incorporation improves the risk/return profile of our indices, we also observe that their improved ESG profiles are achieved with no financial penalty as the ESG and Low Carbon Fiduciary Option versions of our indices achieve back-tested performance that is in line with that of standard versions. Market inefficiencies are naturally possible and could translate in additional risk-adjusted relative performance for the ESG and Low Carbon Fiduciary Option indices if over the holding period, the market realised that excluded/retained securities were over/under-priced for idiosyncratic or systematic reasons.

References:

- Eurosif, 2018. EUROPEAN SRI STUDY 2018. EUROSIF A.I.S.B.L. European Sustainable Investment Forum, Brussels, available at: http://www.eurosif.org/wp-content/uploads/2018/11/European-SRI-2018-Study-LR.pdf.

- Friedman, M., 1970. The Social Responsibility of Business is to Increase its Profits, The New York Times Magazine, September 13.

- Hartzmark, S. M. and A. B. Sussman, 2019. Do Investors Value Sustainability? A Natural Experiment Examining Ranking and Fund Flows. European Corporate Governance Institute (ECGI) - Finance Working Paper No. 565/2018, available at: https://ssrn.com/abstract=3016092.

- Morgan Stanley, 2017. Sustainable Signals – New Data From the Individual Investor (Executive Summary), Morgan Stanley Institute for Sustainable Investing, White Paper, available at: https://www.morganstanley.com/pub/content/dam/msdotcom/ideas/sustainable-signals/pdf/Sustainable_Signals_Whitepaper.pdf.